中国是否会在不久的将来开始经历商业周期, 甚至可能发生经济危机。根据综合分析, 文章得出的结论是:中国可能从2025-2027 左右开始经历商业周期, 然后将经历经济衰退甚至经济危机。文章并进一步讨论了中国可以从其他国家的类似经验中学到什么, 以及应该做些什么来减少潜在的负面影响。

The Business Cycle & Economic Crisis—When Will China Experience Them?

Yueyun(Bill)Chen, UWest

Abstract

This paper focuses on whether China will start experiencing a business cycle and even a possible economic crisis in the near future. Based on comprehensive analyses, it concludes that China may start experiencing the business cycle from the year around 2025-2027 and then it will experience an economic recession and even economic crisis. Then it further discusses what China can learn from other countries’ similar experiences and what it should do to lessen potential negative effects.

Keywords:Business Cycle, Economic Recession, Economic Crisis, China’s Economy

I. Introduction

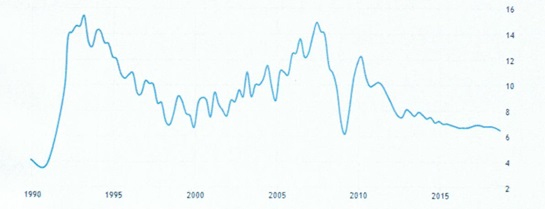

China has experienced rapid, unprecedented economic growth for almost four decades. Its average annual GDP growth rate in the past 40 years was about 9.5% and its average annual international trade growth rate was about 14.5%. But in the past several years, China’s economy has slowed down significantly. In the third quarter of 2018, its GDP growth was only 6.5%. Given the above facts, it is natural to ask whether China will experience a business cycle, and particularly whether it will have a recession in the near future as has happened many times in western economies.

Graph 1. China Annual GDP Growth Rate(1990-2017)(Data source-World Bank)

Knowing these answers will be important to China. China’s amazingly fast developments and achievements in the past decades have led many to believe that China is unique with its own model for economic development; this is called the Beijing Consensus(Ramo 2004)which relates China’s economic success to its innovations in the state sector, including state ownership of firms, close financial controls, and political controls in favor of economic growth. Whether such a model exists is arguable; especially whether China will be able to avoid a business cycle or worse yet an economic crisis, both critical topics are worthy to be explored.

Being successful in past economic developments does not mean that China is so different from the world. In fact, more people have increasingly realized that China has experienced similar barriers and challenges as many developed economies have, such as serious population problems when industrialized, labor-shortage, low birth rates and aging problems when the economy is advanced, and trade tensions and trade wars when being a major exporter. China can learn from others and better prepare for handling these challenges if it realizes that it will be facing similar problems as many developed economies have.

Knowing these answers will also be relevant to the world since China is the second largest economy and in coming six or so years, China will surpass the US to be the largest economy all over the world. China has contributed more than 30% to the world’s economic growth in the past several years. The slowing down of China’s economy has negatively and significantly affected the world economy and a possible business cycle and especially a recession will dramatically influence the whole world.

This paper focuses on whether China will start experiencing a business cycle and even a possible economic crisis in the near future. Based on comprehensive analyses, it concludes that China needs to prepare to deal with these potential challenges. Then it discusses what China can learn from other countries’ similar experiences and what it should do to lessen potential negative effects.

The rest of the paper is organized as follows:Section II discusses the business cycle and its explanations; Section III analyzes the economic recession and economic crisis; Section IV reviews relevant literatures on what will lead to the next economic recession and crisis; Section V gives comprehensive reviews on why China may start experiencing a business cycle and even an economic crisis in the near future; Section VI explores what China can learn from other countries and what it should do to lessen its negative effects from the business cycle and recession. Section VII concludes the paper.

II. The Business Cycle and its Explanations

The business cycle is the significant change(rise or fall)of economic growth over time. Each business cycle has four phases--expansion, peak, contraction, and trough. They do not occur at regular intervals. But they do have recognizable indicators. Expansion is the growing of the economy and it is between the trough and the peak. For the developed economies like the US, the GDP annual growth rate at about 2 to 3% will be called the expansion with unemployment rate at about 4.5 to 5% and the inflation at about 2%. During the expansion, the stock market is in a bull market. A well-managed economy can remain in the expansion phase for years. For example, the US has experienced almost 10 years of expansion after 2008 economic crisis. The peak is the second phase and the economy overheats. For western countries, that is when the GDP growth rate is more than 3% percent and inflation is larger than 2% or even more than 10%. During this stage, investors are in a state of "irrational exuberance," which creates asset bubbles. Then, the third phase--contraction occurs which starts at the peak and ends at the trough. During this period, economic growth weakens and GDP growth falls below 2%. When it turns negative, that is what economists call a recession. During this stage, there will be mass layoffs and the unemployment rate rises. Businesses wait to hire new workers until they are sure the recession is over. Stocks enter a bear market as investors sell. The trough is the fourth phase when the economy hits bottom and it is also the month when the economy transitions from the contraction phase to the expansion phase. The business cycle's four phases can be so severe that they are also called the boom and bust cycle.

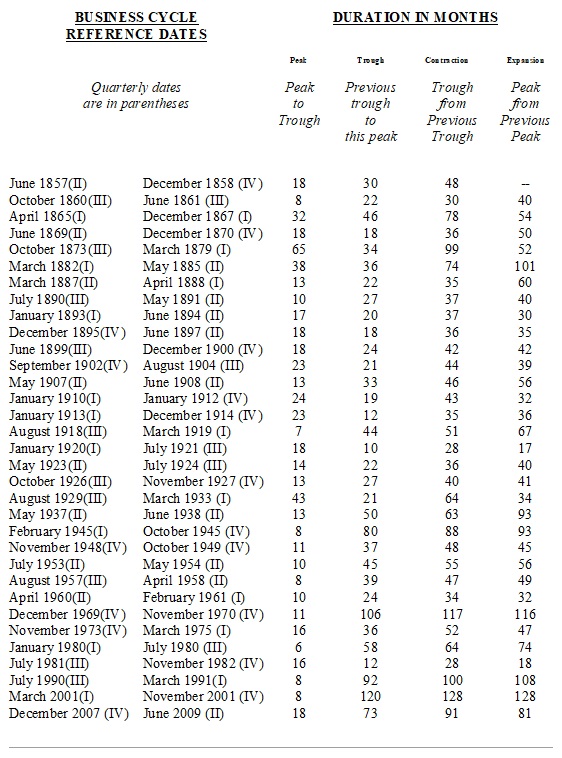

The National Bureau of Economic Research(NBER)determines the official starts and ends of business cycles in the US. The time from one economic peak to the next, or one recessive trough to the next, is considered a business cycle. From the year of 1945 to 2009, the NBER defined eleven cycles, with the average cycle lasting over 5 and half years.

Based on the above discussions, having a business cycle is natural to a mature economy because of dynamic changes of economic activities and so economic outcomes. During the expansion, an economy grows fast, then more employment and so income grows; as a result, there is a potential high inflation and the economy reaches its peak. Then, the interest rate rises and the cost of doing business will rise as well. As a result, its economy slows down and eventually goes to the recession. After it reaches its trough, the economy will recover gradually with increasing of spending by consumers, businesses and governments.

A developing economy may be different since its economic structure and other economic conditions are different as China has experienced in the past four decades. But eventually a previously fast growing economy like China will slow down because of its loss of competitive advantages such as low cost of labor and limited potential of further significant improvements in its economic structure and urbanizations as to be discussed later.

It should be noticed that a developing economy is not immune to the business cycle as US experienced its business cycle from 1857 second quarter to 1858 fourth quarter and 1929 third quarter to 1933 first quarter. The World Bank(2012)reported that in 1960 there were 101 mid-income economies but only 13 of them advanced to the high income-economies in 2008. The others were fallen into the so-called the middle-income trap. Many of them experienced business cycles and economic recessions.

Table 1. US NBER Statistics of US Business Cycles(1857-2009)

|

|

|

Average, all cycles:

1854-2009(33 cycles)

1854-1919(16 cycles)

1919-1945(6 cycles)

1945-2009(11 cycles) |

17.5

21.6

18.2

11.1

|

38.7

26.6

35.0

58.4

|

56.2

48.2

53.2

69.5

|

56.4

48.9

53.0

68.5

|

There have been extensive studies on the business cycle. Two main schools are post or new Keynesian business-cycle models and neo-classical business-cycle models. Post-Keynesian models consider the effects of expectations and frictions on the economy and its growth; it focus on the demand-side shock and its effects. The neo-classical models emphasize the supply-side shocks and believe that demand shocks have little or no effect on real output and employment.

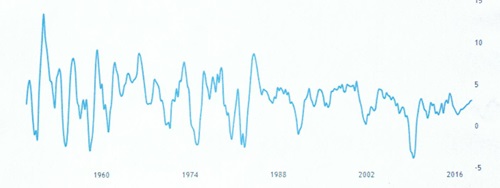

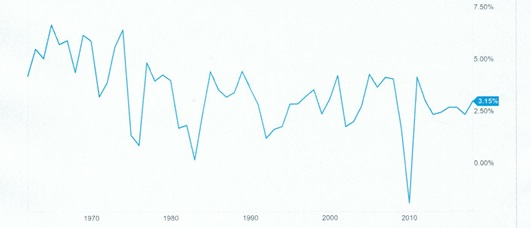

Graph 2. US Annual GDP Growth(1950-2017)(Data source-World Bank)

III. The Economic Recession and Crisis

An economic recession is a business cycle contraction which results in a general slowdown in economic activity. Some economists prefer to define the recession as a 1.5-2.0% points rise in unemployment within 12 months. In most western countries, the recession is now defined as a negative economic growth for two consecutive quarters.

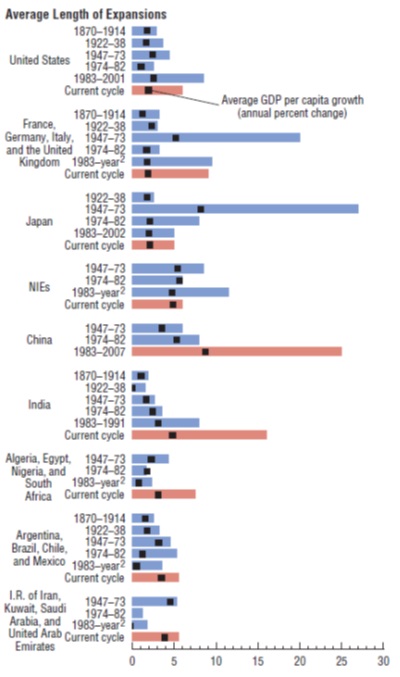

Under ideal conditions, an economy should have the household sector as net savers and the business sector as net borrowers, with the government budget nearly balanced and net exports near zero. When these relationships are imbalanced, an economy can have a recession. The type and shape of recessions are distinctive. In the US, short and sharp contractions, called V-shaped recessions, occurred in 1954 and 1990–1991. These V-shaped recessions usually will be followed by rapid and sustained recovery. The US also experienced the prolonged slump, called U-shaped recession in 1974–1975, and W-shaped(or double-dip)recessions in 1949 and 1980–1982. Japan’s 1993–1994 recession was U-shaped and its eight-out-of-nine quarters of contraction in 1997–1999 are described as L-shaped. Korea, Hong Kong and South-east Asia experienced U-shaped recessions in 1997–1998, but Thailand’s eight consecutive quarters of decline are termed L-shaped. The length of the recession can be quite different. According to the NBER, the average recession lasted 22 months, and the average expansion 27 months.

Graph 3. Average Length and Share of Time Spent in Recessions in the World(1870-2007)

(Data source-World Bank)

Source:National Bureau of Economic Research; data as of July 2014.

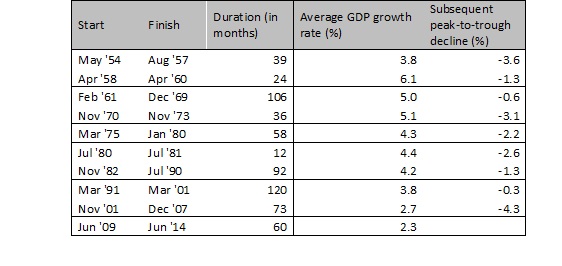

Table 2. US Economic Expansions after the Recessions(1954-2009)

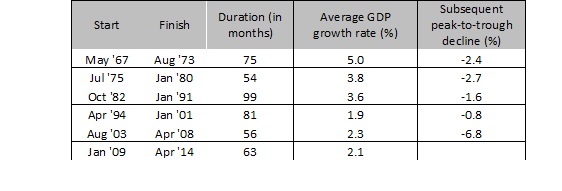

Table 3. Germany Economic Expansions after Recessions(1967-2009)

Source:Economic Cycle Research Institute; data as of July 2014.

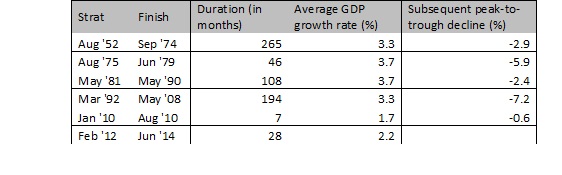

Table 4. UK Expansions after Recession(1952-2014)

Data source:Economic Cycle Research Institute

The global recession is defined differently. Since the Great Recession 2000s, the International Monetary Fund(IMF)has described a “global recession” as a decline in real per-capita world gross domestic product(GDP), as supported by other macroeconomic indicators such as industrial production, trade, oil consumption and unemployment, for a period of at least two consecutive quarters. By this definition, the US Great Recession started in December 2007, while the US NBER defined it as the start from third quarter of 2017.

Graph 4. World GDP Annual Growth Rate(1960-2017)(Data source-World Bank)

Since a recession is part of the business cycle, it is natural or unavoidable that an economy will experience its recession. At the same time, as indicated before, the length of expansions can be distinctive. In other words, how soon the next recession will occur, that will depend on many factors.

Recessions were caused by all different events throughout history. Generally, they occur due to a drop in spending, classified by economists as “an adverse demand shock”. A drop in spending can be triggered by a financial crisis, external trade shock, adverse supply shock, or bursting of an economic bubble. Many recessions in the world were caused by financial crises, such as 1990 South-East Asian Economic Crisis, and 2000s Great Recession in the US. The external trade shock may lead to the economic crisis such as 1970 Oil Embargo and consequently US economic recession. The current trade war could cause the US or even the world’s recession. An adverse supply shock such as oil supply disruption or the serious disruption of supply due to the war or a natural disaster may lead to the economic recession as well. In addition, the economic/financial bubble such as the real estate, stock or .com bubble may cause the economic recession.

An economic crisis must be the economic recession but the economic recession may not lead to the crisis. An economic crisis is the serious economic recession as happened in 1930s and 2000s. An economic crisis not only has more serious negative economic outcomes in terms of the GDP decrease, unemployment rate, and inflation, but also lasts longer time period. For example, the US Great Depression lasted for 4 years and South-East Asian Economic Crisis lasted for several years. A serious financial crisis will lead to the economic crisis as occurred in 1990s South-East Asia and 2000s Great Recession. But it is not necessary that any financial crisis will cause the economic crisis. The European Debt Crisis did not cause the economic crisis to most European countries.

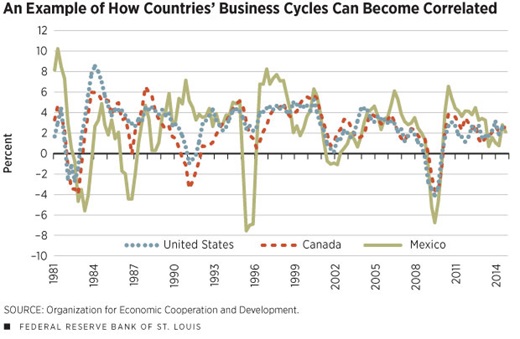

Outcomes from economic crises can be extremely serious. During the infamous Great Depression, US GDP fell 27% and one in four working Americans was unemployed. Also, because of growing globalization, economies in the world are more integrated. As a result, recessions in different economies are more correlated(Lorenzo Ductora, & Danilo Leiva-Leonb 2016).

Graph 5. US, Canada and Mexico Business Cycle Correlations

(Data source-Federal Reserve Bank, St. Louis)

There have been numerous studies on the recessions and economic crises. Some focuses on regional and national recessions and economic crises; others aim at better understanding global ones. Some studies try to explore sources of the recessions and economic crises and the others want to find out any relationships of the recessions and crises among economies(Ductora & Leiva-Leonb 2016).

IV. What Will Lead to the Next Economic Recession and Crisis

It has been ten years since the 2008 economic recession and crisis. Many believe that it is overdue to have another economic recession and even an economic crisis. Then it is essential to know when the next global economic recession and economic crisis will occur. The more important question will be what will lead to the next one. In other words, which economic measurements or events will lead to the economic recession and crisis?

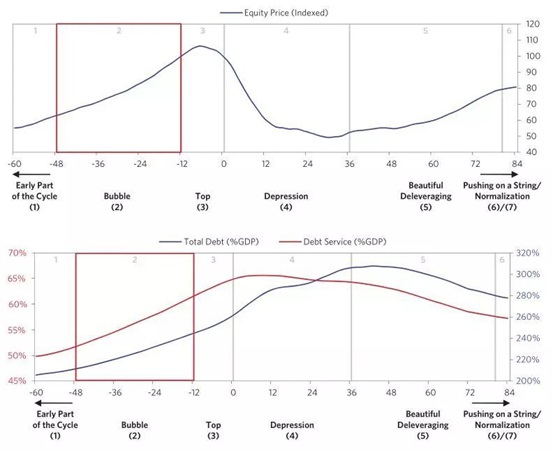

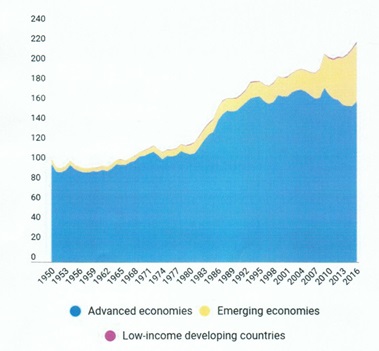

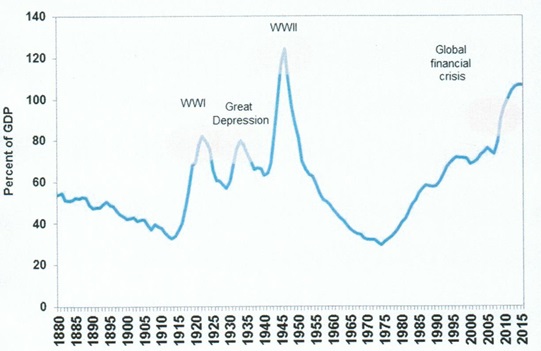

The debts in developed countries and the world can be a big source that may trigger an economic recession or crisis. According to the Merry Lynch(2018), the current debts are too big.

Graph 6. Equity Price & Debts during the Business Cycle(Data source- Merry Lynch)

Graph 7. Government Debts to GDP(1880-2017)(Data source-IMF)

Graph 8. Global Debts of Different Economies(1950-2016)(Data source-IMF)

Graph 9. Advanced Economies Government Debts to GDP Ratio(1980-2015)(Data source-IMF)

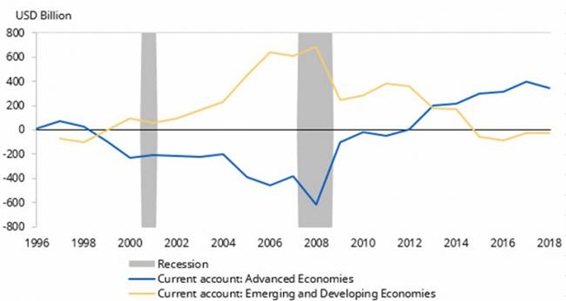

According to Keith Wade(2018), the threat to the world economies is the imbalance of current accounts. The long term and serious international account unbalances of many economies could cause its currencies’ depreciations and that will lead to the financial crisis as occurred in 1990s in Southeastern Asia.

Graph 10. Global Current Account Balance and Recession(1996-2018)(Wade 2017)

The third possible source leading to the recession will be the government’s policy. Nouriel Roubin and Brunello Rosa(2018)analyzed governments’ stimulus policies in world’s major economies and concluded that the current central governments’ fiscal policies are not sustainable and by 2020, the conditions will be ripe for a financial crisis, followed by a global recession.

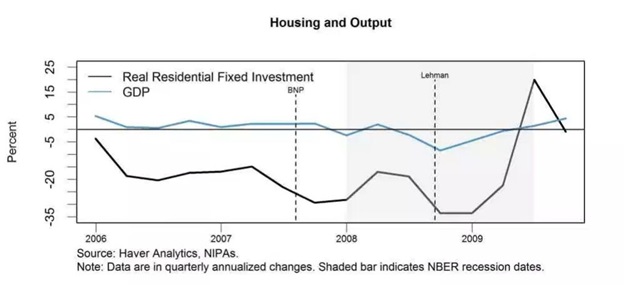

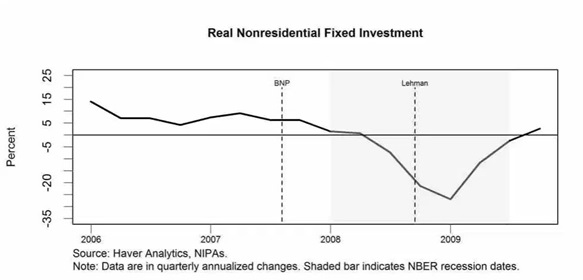

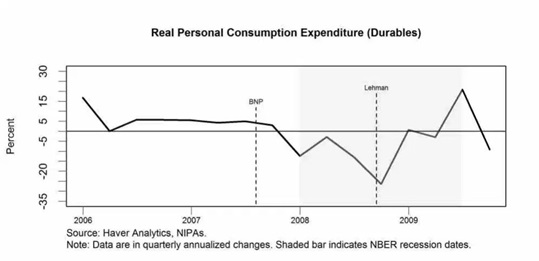

Former Federal Reserve Chairman Ben Bernanke believes that the severity of the Great Recession 2000s largely reflects the negative impact of financial panic on the supply of credit and concludes that the similar financial panic will lead to the next economic crisis.

Graph 11. Housing and Output(Bernanke 2018)

Graph 12. Real Nonresidential Fixed Investment during 2008 Great Recession(Bernanke 2018)

Graph 13. Real Personal Consumption Expenditure during 2008 Great Recession(Bernanke 2018)

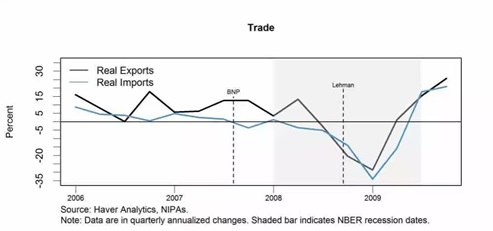

Graph 14. Trade during 2008 Great Recession(Bernanke 2018)

The dramatic economic structure change and particularly large loss of jobs from technological improvement in the economy may also cause the economic crisis. Stiglitz and Bilmes(2012)studied the Great Depression and stated that dramatic decreases of jobs in agriculture from modernization led to the US economic crisis in 1930s. In other words, the economic structure change and particularly employment change in the economy can help improve an economy but on the other hand, it may lead to the economic crisis if many are driven out from one sector but cannot find out the jobs in other sectors. The US now has faced similar problems. Many manufacturers have outsourced and so many jobs have lost, but the new economy or sectors cannot absorb all these lost ones.

Advancements of new technology and especially emerging of disruptive technology are valuable to the economic and social developments. But that will also cause many job losses and income’s redistributions. If an economy cannot solve relevant economic and social problems, that could lead to an economic or even social crisis as witnessed in many western countries.

The last not least, a trade war world-wide and especially a big decrease of the international trade because of the increasing trade barriers and protectionism will lead to the world’s economic recession and crisis. The current US policy and practices in trade have alarmed the world whether a big storm of the recession is coming soon!

V. Will China Experience the Business Cycle and Economic Crisis?

Many factors have contributed to the China’s rapid economic development in the past decades. Its opening policy to the world and economic reforms are the two most important factors. China can still benefit from further opening policy and comprehensive and deeper reforms, but it has been and will be facing many more challenges as many advanced economies have encountered. As a result, China’s economy will not only slow down significantly as already experienced, but also experience the business cycle and eventually recession.

Chen, et al.(2017)studied whether China can avoid the middle-income trap and concluded that three main factors will decide its growth rate and so whether to advance to the high income economy--the productivity, economic structure and labor participation. This conclusion is consistent with many other studies on the economic growth and middle-income traps. Based on this model and considering of China’s urbanization and other factors, it is reasonable to predict that China will experience a business cycle from the year of around 2025-2027.

5.1. Productivity

The productivity is essential to any economy’s growth. Studies found that the US economy has not achieved its recovery fast enough in the past 10 years mainly because of slow productivity improvement. The similar studies of China’s economic growth also concluded that China’s productivity has not been improved much in the past years and as a result, its annual economic growth has been stalled. Whether China can maintain high enough economic growth in the future will depend on whether it can improve its productivity(Chen, et al. 2017).

5.2. The Economic structure

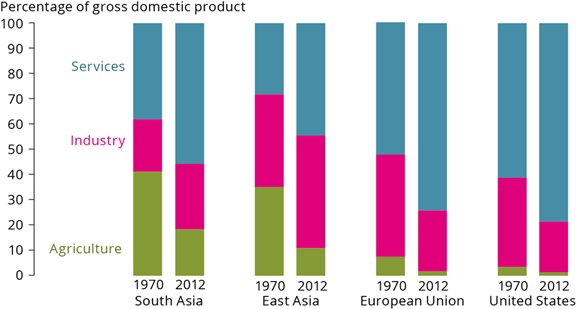

The economic structure is the indicator of the economic development level(Chen, et al. 2016 & 2017). Generally, an advanced economy has high percentage of its GDP and employment in service and very low percentage in agriculture. For example, the US agriculture GDP is only about 1% of its total GDP and service is over 80%. The change of the economic structure is the natural development of an economy and that will lead to the economic growth as China has experienced in the past 40 decades. However, when an economy is mature, the potential change of the economic structure will be very limited. That is the main reason why the US economic structure has not changed much although US Presidents Obama and Trump called for more manufacturers coming back home.

Table 5. World Economic Structure(Data source - World Bank)

|

|

World |

China |

US |

Japan |

Germany |

India |

South Korea |

|

% of GDP in Agriculture |

6.40% |

8.20% |

0.90% |

1% |

0.60% |

16.80% |

2.20% |

|

% of GDP in Industry |

30% |

39.50% |

18.90% |

29.70% |

30.10% |

28.90% |

38.80% |

|

% of GDP in Service |

63% |

52.20% |

80.20% |

69.30% |

69.30% |

46.60% |

59.10% |

|

% of labor force in Agriculture |

26.48 |

17.51 |

1.66 |

3.49 |

1.28 |

42.74 |

4.89 |

|

% of Labor in Industry |

22.44 |

26.62 |

18.89 |

25.58 |

27.26 |

23.79 |

24.79 |

|

% of labor in Service |

51.08 |

55.87 |

79.45 |

70.93 |

71.46 |

33.48 |

70.32 |

Graph 15. GDP Distribution of Different Economies

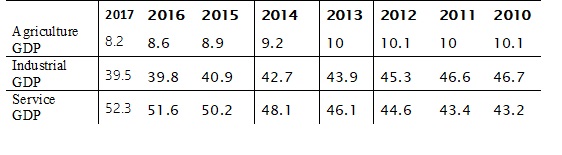

Table 6. GDP Distribution of China(2010-2017)

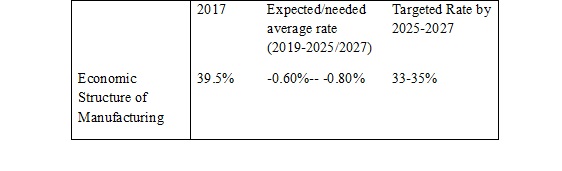

Table 7. China manufacturing industry

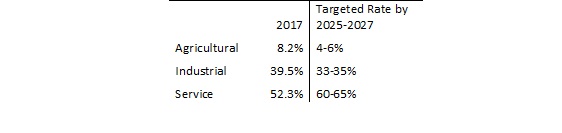

China’s GDP in manufacturing was 39.5% of its total GDP in 2017. If annual GDP in this sector decreases by 0.6-0.8%, then by 2025-2027, its GDP in manufacturing will be about 33-35% of the total GDP. Given Japan and Germany’s experience(each with about 30% GDP in manufacturing), this should be the level that China should have for the manufacturing sector in the whole economy(China, et al. 2017). These analyses imply that the economic benefits from its economic structure change will reach its peak by the year around 2025-2027. Therefore, China’s economy will lose the relevant engine from the change of its economic structure after 2025-2027.

5.3. Labor participation ratio

As Chen et al(2017)modeled that that economic growth and especially GDP per capita relies on the labor force ratio or labor participation rate of an economy. Japan’s economy experienced lost-twenty years and one of the reasons is its over 25 % high aging ratio. According to the World Bank, China’s labor participation rate was 68.93% in 2017 but its maximum was 79.13% in 1990. In the past years, this relevant rate has been decreasing in China. This decreasing rate will negatively affect China’s future economic growth and may lead to its economic recession in the future as many developed economies experienced.

5.4. Urbanization rate

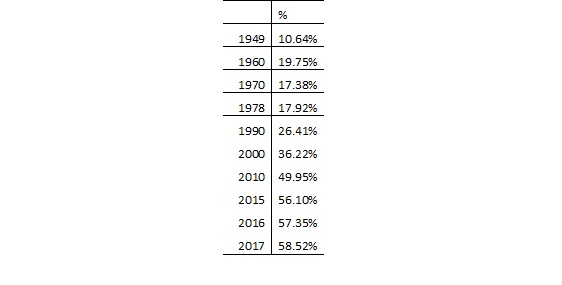

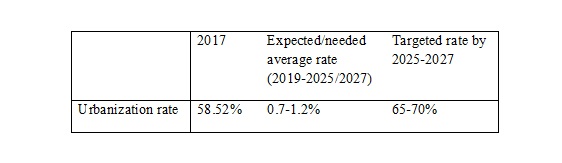

Besides the above three factors that will decide China’s future economic growth potential, the urbanization rate is also crucial. The percentage of people living in cities is an important indicator of the economic development level. The global urbanization rate has been increasing over decades because of the economic developments(Chen 2017)and particularly rising globalization. More people moving to urbans will also generate more demands and consumptions and that will help improve the economic growth. China’s urbanization has been increased dramatically over decades, from less than 20% in 1978 to 58.52% in 2017. If this rate is able to rise by 0.7-1.2% annually, by 2025/2027, China’s urbanization rate will reach to about 65-70%. Given Germany and several other developed countries’ experience in urbanization( at about 70%), it is reasonable to predict that China’s urbanization will slow down after this target level. Then, again the economic benefits from its urbanization will reach its peak by the year around 2025-2027 and China’s economy will lose the relevant engine from this source. Accordingly, in 2025-27, China’ agriculture GDP will be about 5%, and service will be about 60%.

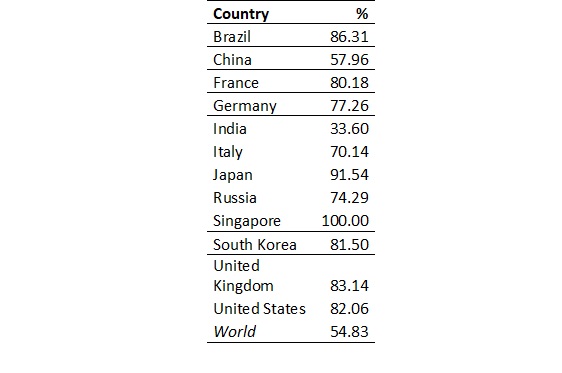

Table 8. World Urbanization Rate(2017, World Bank)

Table 9. China Urbanization Rate(1949-2017, Bureau of National Statistics, China)

Table 10. China Urbanization-Current and Future

China’s Future Economic Structure

5.5. After Becoming the High income-economy

As Chen et al.(2017)discussed, if China is able to raise its GDP per capita 4-5% annually, it will become a high income economy by 2025-2027. As many developed or high-income economies have experienced, China will face more severe challenges and problems after it becomes the high income economy. In conclusion, China’s economic growth will significantly slow down after the year of 2025-2027 and it may start experiencing a business cycle; then it will encounter an economic recession. If China is not well prepared for such challenges and could not deal with the recession appropriately, China will experience its economic crisis.

5.6. Debts issues

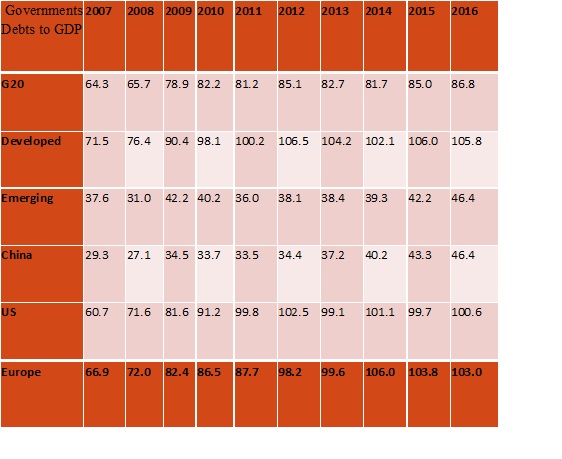

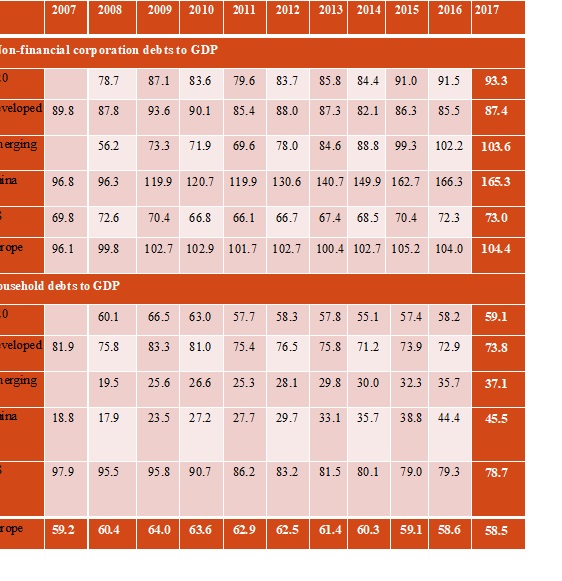

As discussed in the previous section, huge debts may trigger the global recession and economic crisis. China is having the same problems. Currently China’s overall or total debts to its GDP is about 257%, close to most western countries and much higher than most developing countries. But its main problem is that the debt ratio in China has been radically and continuously increasing and particularly the debts by local governments, corporations and even households. A potential debt crisis and so financial crisis could trigger a recession and even economic crisis to China.

Table 11. Government Debts to GDP

Table 7. Corporate and Household Debts to GDP

Table 9. Overall Debts to GDP

It is important to point out that a possible recession and so a business cycle in China is based on the IMF definition, i.e. its real GDP per capita decreases in two consecutive quarters, not the US or other western countries’ definition. Also, as discussed in the previous sections, a business cycle is a natural change of the economy. Many countries have experienced these kinds of cycles over years, but an economic crisis must be triggered by serious shocks or events. To some extent, an economic crisis can be avoided if one is able to take necessary precautions. Then, the question is whether China will start experiencing an economic crisis? If so, what may trigger its crisis? The simple answer is-Yes, China will eventually experience the economic crisis if it starts undergoing the business cycle. An economic crisis will occur if China doesnot well prepare for these challenges and cannot handle its recession well in the future.

VI. What China Can Learn from Other Countries

It has been 10 years since the 2008 financial and economic crisis. People have wondered how soon the next crisis will occur. Based on the business cycle theory, there will be another economic recession in the coming years in the US and other western countries although it is not sure whether such a recession will become an economic crisis. China can learn from western countries experiences.

One lesson is sources or economic activities leading to the crisis; then China can learn on how to check and control these activities and particularly take precautions to prevent spillovers of risk to the whole economy. As discussed before, the high debt and leverage level is the most serious risk to the companies and the whole economy. The China’s current debt level of households, business and governments are very dangerous and create huge risk to its economy. Controlling a such level is crucial to avoid a financial and economic crisis.

The productivity is the most important to the company and economy’s competitiveness and so its success. Compared with many other economies, the productivities in China in all sectors--agriculture, manufacturing and service are still very low. On the one hand, this means that China still has potential to improve its productivity considerably; on the other hand, this shows the China’s weakness and more severe challenges in the future. The Total Factor Productivity(TFP)is the key to the advanced economy and crucial factor to keep stable economic growth.

Innovations are also critical. The most outstanding advantage of the US economy is its innovations. Apple’s market value reached $1 trillion due to its innovative technologies and products. The US economy is not only service-dominated but also needs to be more innovations-centered as Stiglitz and Bilmes stated(2012). China recently has paid increasing attention to the innovations. Its annual R & D investment has been increasing over years and was about 2.14% of its total GDP in 2017.

The further market-oriented reform will strengthen China’s economy. China is far away from being a market economy. This kind of reform will reduce transaction costs and make companies and its whole economy more productive and competitive in the world. But as many western countries have experienced, the market mechanism is not perfect and free market system fails from time to time. One should not deny the critical roles of the market system in determinants of product/service prices and resources allocations. At the same time, one should not have any delusions that the free market system will solve all economic problems. In fact, it will be the free market system that will lead to the economic recession and crisis! In other words, China needs to balance its government’s roles—more free market system and so less government’s interference and at the same lessen negative and dangerous effects of the market system to the economy that may lead to the recession and economic crisis.

Strengthening its manufacturing industry and keeping it as a large sector as possible will be the key to China’s future economic success(Chen et al. 2015). China should not follow the US’s path with very low manufacturing GDP in the total economy. Instead, China should learn from Japan and Germany.

Also as Chen et al.(2017)pointed out that besides three main factors affecting China’s path toward the high income economy and its economic growth, the exchange rate and inflation are relevant and important. A stable exchange rate with some appreciation in the long-term and well controlled inflation will be essential for China’s long-term stable economic development.

VII. Conclusions

This paper studies whether China will experience the business cycle and economic crisis. It explains why many economies have had business cycles over years and what have led to economic crises. Then, based on comprehensive analyses of the productivity, economic structure, labor participation and urbanization in China, it concludes that China will start experiencing the business cycle and even economic crisis after the year around 2025-2027. The paper also discusses what China can learn from western countries’ similar experiences and what it should do to better prepare for future severe challenges.

One issue on whether China can avoid any future economic crisis is its large economic size. It is true that a large economy will be more resistant to external shocks and can recover faster and better from the recession than small economies. That is one of the reasons why the US economy did not suffer so much from the recent economic crisis and has recovered much better and faster than other western countries. However, as witnessed, a large economy cannot eliminate the risk of the economic recession or economic crisis and the consequences from that still can be extremely severe as occurred during the Great Depression. In other words, even China becomes the largest economy in the world in the future, it still will face the risk of the economic recession and crisis. In fact, China will have the higher chance to encounter the recession and economic crisis after it surpasses the US economy because it will have less flexibility to use the world economy/markets to lessen adverse impacts from its own business cycle.

Facing a business cycle or even an economic crisis is not the end of life. Like a person becomes stronger and healthier after a disease, China will continuously improve its economy and be more competitive in the world even though it is near the stage of facing more severe challenges.

China needs to recognize that its economy is not so different from the others and particularly it needs to and should learn from other countries’ similar experiences; as a result, China will be better prepared to handle potential recession and even the economic crisis. It should better use its large economy and differentiations of economic development levels of regions, i.e. use the gradient economic theory to better take competitive advantages of different regions.

Also, even China’s urbanization rate reaches its up-limit such as 70% in the year around 2025-27, it still needs to solve residential issues of many farmers in cities/towns. Currently about 270 million farmers are living/working in these cities/towns, so counted as the urbanized, but they donot have residential certificates so that they donot have benefits like other regular urbanites there have had, in terms of education, medical service and social security. Continuously solving these problems will not only be the social justice issues, but also generate its economic growth since these actions will bring more investments and consumptions.

References

Artis, Michael J., Zenon G. Kontolemis, and Denise R. Osborn(1997), “Business Cycles of G7 and European Countries,” Journal of Business 70, pp. 249&279;

Backus, David K., and Patrick J. Kehoe.(1992), “International Evidence on the Historical Properties of Business Cycles,” American Economic Review 82, pp. 864-900;

Bordo, Michael D., Haubrich, Joseph G(2017), “Deep Recessions, Fast Recoveries, and Financial Crises:Evidence from the American Record”, Economic Inquiry, Vol. 55 Issue 1, p527-541;Canova, Fabio, and Harris Dellas(1993), “Trade Interdependence and the International Business Cycle,” Journal of International Economics, pp. 23-47;

Chen, Yueyun(Bill), et al.(2017), “The Productivity, Economic Structure and Middle-Income Trap—Can China Avoid this Trap?” Journal of Applied Business and Economics, Volume 19(11);

Chen, Yueyun(Bill)(2017), “Purple Ocean Strategy and the Development of Urban Agglomerations”, Academic Perspective, Volume 13;

Chen, Yueyun(Bill)(2016), International Comparisons of the Service Industry-What China can Learn from the Other Countries?” Journal of Advances in Economics and Finance;

Chen, Yueyun(Bill)(2016), “International Comparison of Agriculture Industry—What China can Learn from Others?” Int’l Journal of Agricultural Economics, July;

Chen, Yueyun(Bill)(2015), “China’s Path to the Sustainable, Stable and Rapid Economic Development:From the Largest to the Strongest Manufacturing Country,” Journal of World Economic Research, August;

Diebold, Francis X., and Glenn D. Rudebusch(1996), “Measuring Business Cycles:A Modern Perspective,” The Review of Economics and Statistics(February), pp. 67-77;

Diebold, Francis X., and Glenn D. Rudebusch(1999), “Business Cycles:Durations, Dynamics, and Forecasting,” Princeton:Princeton University Press;

Diebold, Francis X, Rudebusch, Glenn D.(2001), “Five Questions about Business Cycles,” Economic Review, pp1- 15;

Fort, Teresa C, Haltiwanger, John, Jarmin, Ron S, Miranda, Javier(2013), “How Firms Respond to Business Cycles:The Role of Firm Age and Firm Size”, IMF Economic Review, Vol. 61 Issue 3, p520-559;

Francis, Neville, Owyang, Michael and Soques, Daniel(2015), “Does the United States Lead Foreign Business Cycles?” Review, Federal Reserve Bank of St. Louis, GLOBAL Financial Crisis, 2008-2009;

Gregory, Alan W., Allen C. Head, and Jacques Raynauld(1997), “Measuring World Business Cycles,” International Economic Review, pp. 677-701;

Hansen, Gary D., and Edward C. Prescott(1993), “Did Technology Shocks Cause the 1990&1991 Recession?” American Economic Review, Papers and Proceedings 83(2)pp. 280-286;

Henzel, Steffen R., Rengel, Malte,(2017), “Dimensions of Macroeconomic Uncertainty:A Common Factor Analysis,” Economic Inquiry, Vol. 55 Issue 2, p843-877;

Kose, M. Ayhan, Otrok, Christopher, Whiteman, Charles(2003), “International Business Cycles:World, Region, and Country-Specific Factors,” American Economic Review, Vol. 93 Issue 4, p1216-1239;

Keith, Wade(2018), “Where might the next global financial crisis come from?” Professional Adviser;

Kouparitsas, Michael A.,(2002), “Understanding U.S. regional cyclical comovement:How important are spillovers and common shocks?” Economic Perspectives, Vol. 26, Issue 4, p30;

Kouparitsas, Michael A(1998), “Are international business cycles different under fixed and flexible exchange rate regimes?” Economic Perspectives, Vol. 22 Issue 1, p46-64.

Lopes, António M., Tenreiro Machado, J. A. , Huffstot, John S., Mata, Maria Eugénia(2018), “3

Dynamical analysis of the global business-cycle synchronization”, PLoS ONE, Vol. 13 Issue 2, p1-25;

Perron, Pierre(1989), “The Great Crash, the Oil Price Shock, and the Unit Root Hypothesis.” Econometrica, pp. 1,361-1,401;

Potts, Jason and Tom Mandeville(2007), “Toward an evolutionary theory of innovation and growth in the service economy,” Prometheus, pp.147-159;

Ray, Dalio(2018), “Big Debt Crises”, Bridgewater

Sargent, Thomas J.(1976), "A Classical Macroeconometric Model for the United States," Journal of Political Economy, vol. 84, pp. 207-37;

Stiglitz, Joseph E. & Linda J. Bilmes(2012), “Agricultural Revolution Led to the Great Depression in 1930s” The Book of Jobs;

Watson, Mark W.(1994), “Business Cycle Durations and Postwar Stabilization of the U.S. Economy.” American Economic Review, pp. 24-46.