本文主要侧重于对不同国家的服务业分析,并通过此全面的研究和国际比较,希望像中国这样的发展中国家可以多向发达国家学习,同时更好地发展自身服务业。经济在飞速发展的过程中,在国内生产总值和就业方面,服务业将突显出其重要地位。但制造业的快速萎缩和服务业快速扩张可能会导致严重的问题,例如,生产效率的降低及中等收入陷阱问题。为了维持经济增长,中国需要更好地拓展和发展服务业,特别是完善和发展社会化,专业化和制造/生产服务,及高质量的服务出口。

关键词:服务业,经济结构,经济发展,与中国经济。

International Comparisons of the Service Industry —

What China Can Learn from Other Countries

Yueyunn(Bill )Chen, University of the West, Los Angeles

Abstract

This paper focuses on analyses of the service industry in different countries over the years. Through this comprehensive study and international comparisons, developing countries like China can learn from others and better develop its service industry.

When an economy advances, its service industry will be increasingly important in terms of shares of GDPs and employment. But fast-shrinking of the manufacturing industry and rapid expansion of the service industry may cause serious problems such as being weightless, lowering productivity and suffering from the mid-income trap.

To sustain its economic growth, China needs to better expand and develop its service industry, particularly improve and develop social, professional and manufacturing/production services and improve and increase its service export.

Keywords:Service Industry, Economic Structure, Economic Development, and China’s Economy

I. Introduction

The development of the service industry is crucial to a country’s economy. The level of a country’s service industry, particularly its ratio of the service industry added-value to the gross domestic product(GDP), indicates the country’s economic development stage. In other words, when a country advances from an underdeveloped to developing and then developed economy, its service industry will be increasingly important and its percentage of the GDP and percentage of employment in the service sector will rise.

Many developing economies rely on its manufacturing industry. This is particularly true for export-oriented countries. When a country is underdeveloped or is at the beginning of its development, the total demand for service is low. The priority of the economy is to feed people and provide necessary products—mainly agricultural and manufacturing products. Also, in order to maintain its rapid economic growth, such a country needs to export manufacturing products since it does not have any competitive advantages in its service products. The fact that 70 percent of the world trade is in manufacturing products further confirms that an export-oriented developing economy needs to rely on its manufacturing industry.

After a country has experienced economic development for many years, particularly rapid growth, the country’s living standard is raised significantly; then the cost of producing these manufacturing products rises very fast. As a result, their manufacturing products will be less competitive in the world market. When combined with a retrenching world economy, then this kind of manufacturing and export-oriented country will be faced with economic trouble. That is what China has experienced in recent years. In order to stabilize its economy, a country like China must grow its service industry.

China’s experience is not unique. Many rapidly growing developing countries such as South Korea and Japan have had similar experiences decades ago. But expanding the service industry and over-shrinking the manufacturing industry may cause new problems to these developing countries. For example, its economy becomes weightless and less productive and competitive. Therefore, it will be valuable to conduct a comprehensive and dynamic study of the service industry’s developments in different countries and provide international comparisons. From this, emerging countries like China can learn from the others’ similar experiences.

Each country is different in terms of its available natural resources, population and other factors that will affect and decide its economic structure and international competitive advantages. Both Germany and the US are developed countries, but the ratio of the service GDP to its total GDP is about 70% in Germany and 80% in the US. Therefore, one can learn from other countries’ relevant experiences, but each country needs to develop and implement its economic strategy based on its unique conditions. Particularly an economic strategy needs not only to be based on long-term clear objectives and goals and sound execution, but also to be stable and well balanced. Dramatic changes in economic policies and strategies will cause more troubles than the solutions.

The rest of this paper is organized as follows:Section II reviews relevant literature related to the service industry; Section III analyzes relevant data; Section IV discusses what China can learn from other countries and what it should do; and the last section concludes the paper.

II. Review of Literature on the Service Industry

An economy consists of three sectors--agriculture, industry and service. The development of the service industry will change a country’s economic structure. Such a development is always directly related to a country’s economic growth. Therefore, the literature on the service industry development is included in both the economic structure and economic growth. In addition, a country’s development of its service industry is related to its industrialization and modernization. Thus there are studies on the service industry from perspectives of the industrialization/modernization. One can also study the service industry in terms of international trade, particularly globalization.

Economic Structure Theory

Silva and Teixeira(2008)and Kruger(2008)conducted comprehensive surveys of literature on economic structural change. The root of the study on the economic structure can be traced back to Turgot(1766)and Smith(1776). Fisher(1939, 1952)defined the economic sectors and indicated that economic structure change occurs when the consumer’s preference changes and/or the productivity of the specific sector gains. Kuznet(1966)gave arguments on why a country’s economic structure changes and emphasized the four factors that will lead to the structural change--increasing demand for non-agricultural products, higher incomes and demand for importing products, international trade with less developed countries, and technological progress.

Baumol(1967)raised a serious issue on economic structural change called ‘cost disease.’ It involves a rise of salaries in jobs that have not experienced any labor productivity increase. Although the productivity in the service is not increased, firms in this industry need to pay more in order to retain and attract workers because the productivity in other sectors(industry sector)has risen and therefore salaries rise there. The associated outcome from this cost disease is that productivity growth in the whole economy will slow down when resources shift to service industry. Oulton(2001)showed that the above outcome is true only for service industries which provide final goods but not true for the ones providing intermediate goods.

Economic Growth Theory

What is the relationship between economic growth and structure change? According to neoclassical growth theory(Solow(1956, 1957))and new growth theory(Lucas, 1988)(Romer,1986, 1990), technological progress is the only main factor contributing to economic growth. Economic growth warrants transfer of resources from low-productivity primary production to high-productivity secondary sectors. At the mature stage, resources then are transferred from secondary to tertiary sectors(Clark 1958, Rostow 1960, Lewis 1972). That is what the world economy has generally experienced, i.e. when the economy advances, more resources will be shifted from the agricultural sector to the industry sector, and then to the service sector.

Pelka(2005)developed theoretical models and found that only the economic growth process promotes structural change. However, Dietrick(2009)used OECD data from 1960-2004 and found evidence that economic structure change causes aggregate economic growth, and conversely aggregate growth leads to economic structure change. In other words, the relationship between economic growth and structure change is dynamic and interactive.

Industrialization/Modernization and Service Industry

Industrialization accelerates technological progress and improves productivity. That further leads to rapid shifts in production and labor from primary/agriculture to the secondary/industry sector. Consequently, the service sector rises as supported arguments stated by Kuznet(1966). Hansen and Prescott(2002)showed the importance of technology to growth after industrial revolution.

Modern economic growth depends on the shift from a pre-industrial land-intensive Malthusian technology with decreasing return to labor, to a Solowian constant returns-to-scale technology, with both capital and labor as inputs. Post-industrial theory(Touraine,1969, Bell, 1973), Castells and Aoyama, 1994))states that the more advanced an economy, the more its employment and production would be focused on services. The one main source of such shifts is the information and its technology. Knowledge and information are the main sources of productivity and growth, and so the modern economy has become the information economy(Porat, 1977, Nelson, 1981, Monk, 1989, Denison, 1985, Sautter, 1976, Baumol et al, 1989).

Castells and Aoyama(1994)conducted an empirical study of employment structure in G-7 countries from 1920-1990 and concluded that the post-industrialization led to:

“the phasing out of agricultural employment, the steady decline of manufacturing employment, the rise of both producer services and social services, the increasing diversification of service activities as sources of jobs, the rapid rise of managerial, professional and technical jobs, the formation of a white-collar proletariat of semi-skilled clerical and sales workers, a substantial and relatively stable share of employment in the retail trade, and the overall upgrading of the occupational structure over time, with an increasing share going to occupations that require higher skills and advanced education.”

The authors further proposed two different informational models:(1)a “service economy model” represented by the US, UK and Canada. These countries have had rapid decline of manufacturing employment after 1970s and(2)an “info-industrial model” represented by Japan and Germany. In these two countries, the share of manufacturing employment has reduced significantly, but it has maintained at a relatively high level(about 25%). Other G-7 countries fill in between these two models.

Although the service industry becomes increasingly important in a developed economy, many services and its jobs are directly related with the manufacturing industry. Cohen and Zysman(1987)argued that the post-industrial US economy is not the service economy but is a “myth”. They estimated that 24% of the US GDP comes from the value added by manufacturing firms and another 25% of GDP comes from the contribution of services directly linked to manufacturing.

There are different types of services, including finance, real estate, health, and education. Stiglitz(2012)emphasized that the US needs to develop a creative economy and transfer jobs from manufacturing to services that people want—into productive activities that increase living standards, not those that increase risk and inequality. He particularly suggested that governments should invest in education and support basic research. Potts and Mandeville(2007)emphasized the importance of innovation in services, and they argued that services firms should better use information and communication technologies to coordinate service production and delivery.

International Trade and Service Industry

As Kuznet(1966)argued, increasing income will raise demand for importing products, and also trade with less developed countries will affect a country’s economic structure. As we have witnessed, developed countries produce less and less manufacturing products and they buy these products from developing or underdeveloped countries. The service industry becomes increasingly significant and important in developed countries along with rapid increase in international trade and globalization.

International trade in service has been increasing in the past decades. Some services must be localized such as haircuts and facility maintenance. But others can be traded. Financial services now has been highly internationalized and globalized. Western banks and insurers are successfully expanding their businesses in developing countries. Productivity and competitiveness are the keys to the service trade.

Globalization has made the world more flat. Besides the significant increase of the world commodity trade, globalization brings more foreign direct investments and makes financial services more important.

III. Data Analyses and Implications

1. The World Total GDP and Service GDP

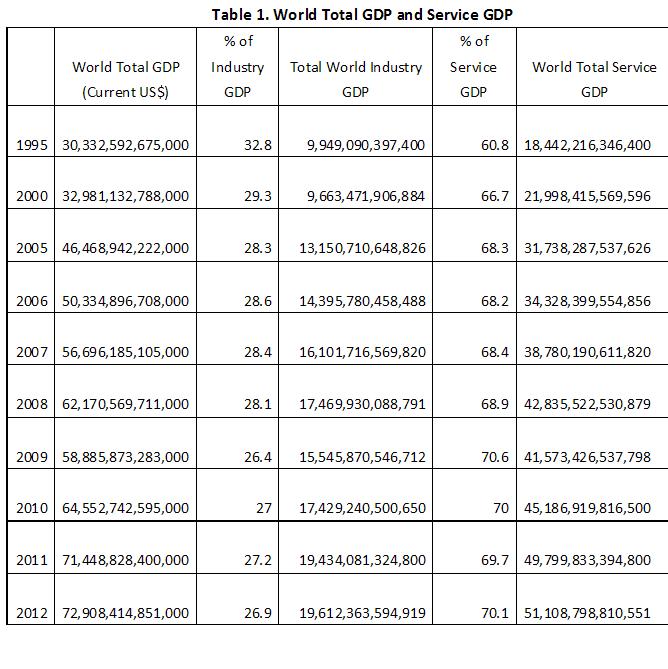

The above table shows the world total GDP, world total service GDP, and percentage of the service GDP to its total GDP since 1995.

The above table shows the world total GDP, world total service GDP, and percentage of the service GDP to its total GDP since 1995.

The above table shows the world total GDP, world total service GDP, and percentage of the service GDP to its total GDP since 1995.

The world total service GDP was about 70% of the world’s total GDP in 2012; it was about 67% in 2000 and about 60% in 1995. Overall, the service industry has been increasingly important.

2. The World Total Trade and Total Service Trade

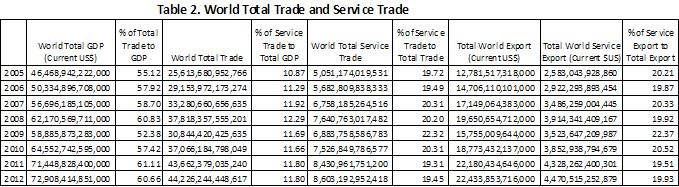

Table 2 provides the world total trade, world total service trade, and service export as well as the relevant percentage of the service trade and service export.

The world total trade has been increasing over the years. It was about 61% of the world’s total GDP in 2012 while it was about 55% in 2005. According to the World Bank data, the world’s total service trade was about 20% of the total trade, and the service export was also about 20% of the world’s total export in 2012. However, based on the analysis by McKinsey(2012), the world’s service export composes about 30% of the world’s total export.

3. GDP per capital in China and other countries

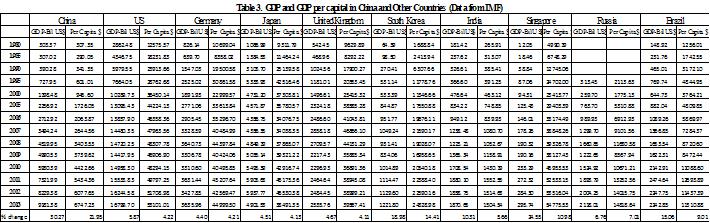

A country’s economic development level will affect its economic structure, particularly its service sector’s GDP and employment shares. Table 3 shows the total GDP and GDP per capita of selected countries from 1980-2013.

During 1980-2013, China’s GDP was increased by 30.27 times and its GDP per capita by 21.95 times; US total GDP increased by 5.87 times and per capita by 4.22; Germany total GDP by 4.40 times and per capita by 4.21; Japan’s increases were 4.51 and 4.13; UK was 4.67 and 4.11; Korea was 18.98 and 14.41, and Singapore was 24.55 and 10.98. At the same time, other BRIC countries experienced the following rates:India’s GDP increased by 10.31 and per capita by 5.66; Russian increased by 6.76 and 7.01(from 1995 to 2012)and Brazil increased by 15.06 and 9.01, respectively.

Based on the above statistics, China had the highest percentage increases in total GDP and GDP per capita during these years. UK had the lowest GDP per capita increase and Germany had the lowest GDP increase during the time period.

Also, among all of these countries, in 2013 Singapore and the US had the highest GDP per capita(above $50,000); Germany, UK and Japan were the next group, each with about $40,000 GDP per capita; Russia and Brazil were above $10,000 GDP per capita; China was about $7,000 GDP per capita; and India had the lowest with about $1,500 per capita.

4. China and Other Countries’ Service GDP and Service Employment

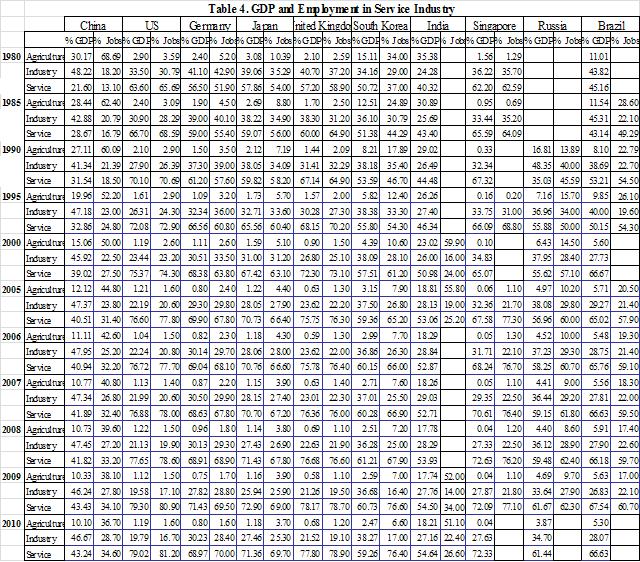

Table 4 shows the percentage of service GDP to its total GDP and percentage of service employment to its total employment in China, US, UK, Japan, South Korea, Singapore, India, Russia, and Brazil.

From 1980 to 2010, the US service GDP share increased from 63.60% to 79% and its employment share increased from about 65.69% to 81.20%.

China’s relevant share of service GDP was 21.60% in 1980 to 43.24% in 2010 and employment share increased from 13.10% in 1980 to 34.60% in 2010.

In Germany, service GDP was 56.50% in 1980 and 68.97% in 2010; and service employment increased from 51.90% in 1980 to 70.00% in 2010.

In Japan, the service GDP was 57.86% in 1980 and 71.36% in 2010; the service employment was 54.00% in 1980 and 69.70% in 2010.

In UK, it was 57.20% of service GDP in 1980 and 77.80% in 2010; and it was 58.90% of service employment in 1980 and 78.90% in 2010.

In South Korea, the service GDP was 50.72% in 1980 and 59.26% in 2010; the service employment was 37.00% in 1980 and 76.40% in 2010.

In Singapore, the service GDP was 62.20% in 1980 and 72.09% in 2010; and the service employment was 62.59% in 1980 and 77.10% in 2009.

In India, the service GDP was 40.32% in 1980 and 54.64% in 2010; the service employment was 24.00% in 2005 and 26.60% in 2010.

In Russia, the service GDP was 35.03% in 1990 and 61.67% in 2009; the service employment was 45.59% in 1990 and 62.30%.

In Brazil, the service GDP was 45.16% in 1980 and 67.01% in 2011; the service employment was 49.29% in 1985 and 62.70% in 2011.

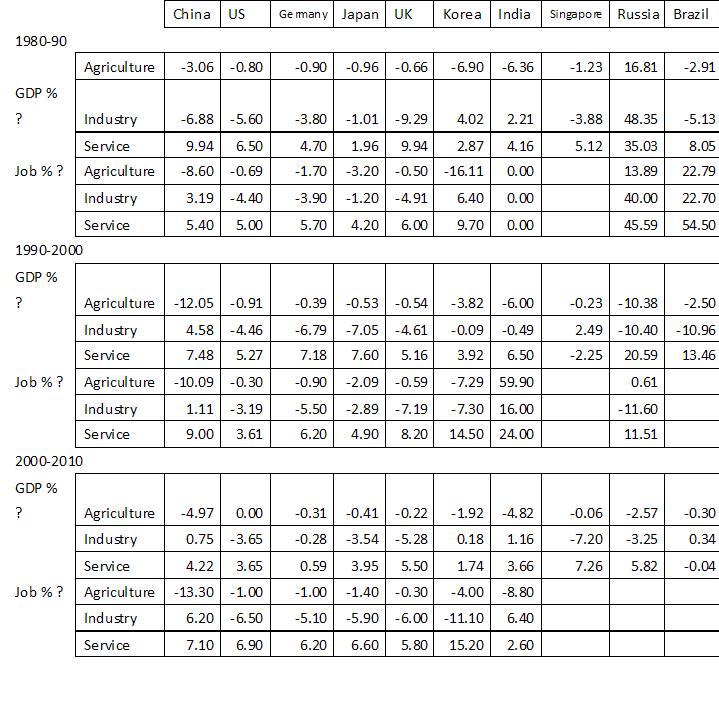

Table 4b. Percentage Changes of GDPs and Jobs in Service Industry in Different Time Periods

Table 4b gives the percentage changes of GDP and Jobs between 1980-1990, 1990-2000 and 2000-2010 in three sectors in these selected countries. The data show how jobs and associated GDPs are shifted from other sectors to the service sector.

The above analyses indicate that in around 30 years, in each of these selected counties, its service sector GDP and employment were increased significantly. In developing countries, the percentage increase of the GDP during the time period surpassed its percentage increase of the service employment. That means the whole economy’s productivity was improved when the labor was shifted to the service sector(mostly from the agricultural sector). However, in developed countries, the percentage increase of the service GDP was slowed down clearly while the service employment increased significantly. That indicates that with the maturity of the economy, the shift of labor to the service sector(mostly from manufacturing)lowered a country’s productivity.

As many other countries have experienced, such as China and India with their continued fast economic growth, more jobs will be shifted into the service sector. Currently, service employment is about 36% in China and 28% in India. In other well developed countries, this figure is between 70-80%. Even in Brazil, it is above 60%.

However, one needs to consider that both China and India are large populous countries and both are still under the industrialization stage; therefore their agriculture and industry sectors and its developments will remain to be essential to them. As a result, the shifts of labors to the service sector in these two countries in the coming decade will not be so dramatic as happened in western countries. The reasonable expectation will be about 45% of employment in the service sector in China and 38% in India by 2025.

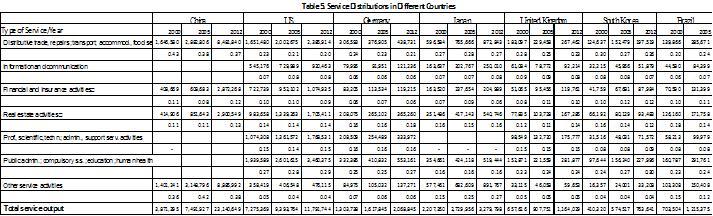

5. China and Others Countries’ Service Sector Distribution

Table 5 lists the GDP in each service sector in these selected countries in 2000, 2005 and 2012. In China, percentage of GDP in “Distributive trade, repairs, transport, accommodation and food service” to its total service GDP was about 40%; the GDP in “Financial and insurance activities” was about 10%; it was about 10% in “Real estate activities” and 36% in “Other services”. China does not have relevant statistics in “Information and communication”, “Professional scientific, technology, administrative, support service activities”, and “Public administration, compulsory social service, education, human health”. The lack of GDPs in these three sectors could be due to the differences in classifications. Most likely, these missed services should be included in “Other services”. In the US, “Distributive trade, repairs, transport, accommodation and food service” composed about 20% of the total service GDP, and the share of “Public administration, compulsory social service, education, human health” was about 28%. In South Korea, it was about 27% each in “Distributive trade, repairs, transport, accommodation and food service” and “Public administration, compulsory social service, education, human health”. Compared with other countries, China’s GDP shares in “Information and communication” , “Professional scientific, technology, administrative, support service activities”, and “Public administration, compulsory social service, education, human health” were too low.

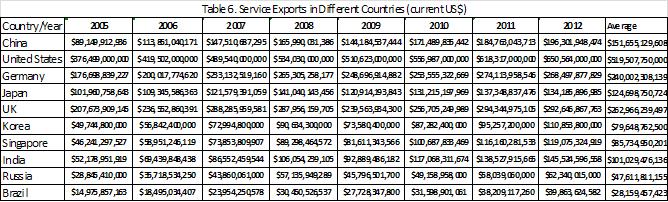

6. China and Other Countries’ Service Exports

Table 6 provides the total service exports of selected countries during 2005-2012. The US is ranked as #1 in total exports in each of these years, UK #2, and Germany # 3. Although China is #1 exporter in the world, its total service export was only ranked #4, with the average annual service export of $151,655,129,608, which was less than 30% that of the US(average annual service export of $519,507,750,000).

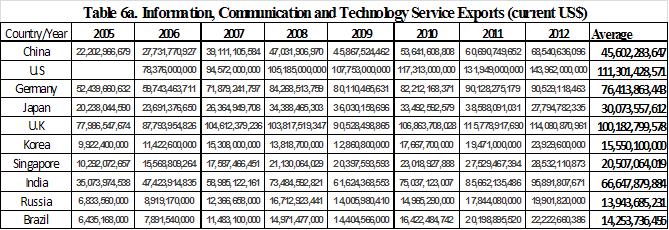

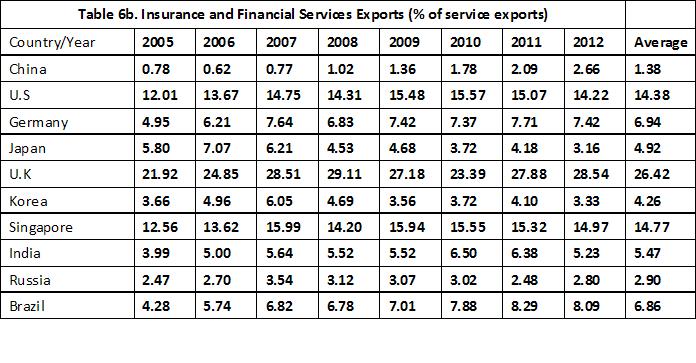

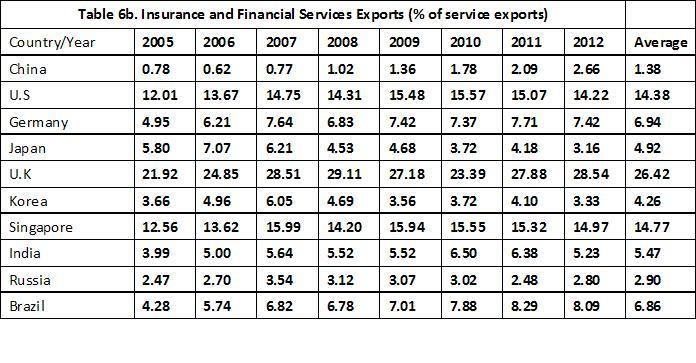

Table 6a is the exports in Information, Communications and Technology during 2005-2012. China’s annual ICT export was ranked as # 5, less than that of India.

Table 6b is the percentage of Insurance and Finance export to the country’s total service export during 2005-2012 for these selected countries. China has the lowest percentage with only 1.38% among all of these selected countries. UK is ranked as #1 with 26.42%, Singapore #2 with 14.77%, and US # 3 with 14.38%. Even other BRIC countries--Russia with 2.90%, India with 5.47% and Brazil with 6.86 % -- were much higher than China’s percentage.

Through the above analyses, it’s clear that China needs to improve its service industry’s competitiveness so that it can export more services. In particular, China needs to strengthen its services in sectors of Information and Communications and Insurance and Finance. More Chinese companies are doing business in other countries, and China’s FDI outwards have been increasing over the years. There should be more demand for relevant services in overseas from Chinese companies, especially in the areas of insurance, finance and professional services such as legal and accounting.

IV. What China Can Learn from Other Countries and What it Should Do

China is at the crucial stage of its economic development. It needs to identify new sources and engines to sustain its stable growth since previous approaches using mass exports and government investments have reached their limit. Stimulating domestic consumption and better developing its service industry have become China’s new directions.

As outlined in my paper(Chen, 2014)), currently manufacturing exports comprise 93% of China’s total exports. Worldwide, that number is about 70% of total exports. Given China’s development stage and employment needs, China still needs to continuously improve its manufacturing industry and export enough such products. In particular, China needs to become the strongest manufacturing country to sustain its economic growth. Interestingly, Prime Minister Li Keqiang used the same words to emphasize the importance and improvements of China’s manufacturing industry in its annual report to China’s Congress in March this year. He further outlined China’s Manufacturing Industry 2025 similar to Germany’s Manufacturing 4.0.

Besides stabilizing and improving its manufacturing industry, China certainly needs to expand and strengthen its service sector. As discussed in the previous sections, increasing importance and particular growing shares of employment and GDPs in services have been the worldwide trend that many developed countries have experienced. The issues germane to China are:how fast the service sector development can be and what will be potential problems, and how to solve them if service development is too fast.

Currently, China’s service GDP is about 40% of its total GDP and employment is about 30% of total employment. In the past 12 years, China’s annual GDP share in service rose by 0.47% and job share by 0.61%. By 2025, China should expect about 50% GDP and 45% jobs in its service. By 2035, service GDP should be around 55% and employment around 52%.

China's Expected GDP and Jobs in 2025 and 2035

There will be some serious outcomes and problems if China grows its service sector too fast, i.e. its GDP and employment shares in services are too high, compared with the above proposed ranges.

1. Weightless. As some western countries have experienced, manufacturing outsourcing led to their economies to be weightless. The US government has called for manufacturers to come back to the US. If its GDP share in manufacturing becomes too low(less than 40%, or even lower than 35%), China’ economy will face the weightless problem. Many better paid jobs in manufacturing will be lost and outsourced to other developing countries.

2. Cost Crises. As Baumol(1967)stated that shifting jobs from manufacturing to service may cause the cost crisis. The productivity in service is not rising but the average salary must be raised because of job market competition and the productivity’s improvement in manufacturing, so the salary rises there. If such a crisis occurs, service firms will suffer and that will further negatively affect the whole economy.

3. Overall Productivity. When jobs shift from agriculture to manufacturing, the whole economy’s productivity improves significantly. When too many jobs shift from manufacturing to service, the average productivity will be lower.

4. Low Salary. Usually, average salary in service is lower than in manufacturing. When many people move from manufacturing to service, their salary and income will be lower. That has been the case in many developed countries.

5. Competitiveness. The competitiveness is essential to an economy’s strength. Globalization makes a country’s competitiveness more important. Overdevelopment and shrinking of manufacturing sector will lead China to lose its competitiveness in the world. What are China’s competitive advantages? More in manufacturing or in service?

6. Exports. Given China’s large population and economic development stage, having enough exports will still be crucial to China’s economy in coming decades, although contributions of the exports to China’s GDP should be gradually lower. For more than two decades, China relied on increasing exports to support its rapid economic growths. In some years, the ratio of export to its GDP was above 40%. In the future, China needs to rely more and more on its domestic consumption. But China still needs to maintain its fair share of the world’s exports. If China cannot develop and implement an appropriate economic structure strategy and improve and strengthen both manufacturing and service sectors, it then will lose more world market share.

7. Mid-income trap. When a country uses its competitive advantages to advance its economy and reaches a certain income level, it may get stuck at that level because these previous competitive advantages have become obsolete and new ones could not be created. That is called the ‘mid-income trap’ as some newly industrialized countries like South Africa and Brazil have experienced. Their per capita GDP has remained around $10,000 for more than a decade. These countries have suffered from low investment, slow growth in manufacturing, limited industrial diversification and poor labor market conditions. China’s GDP per capita at present is around $7,000 and will reach $10,000 in about 6 years. To avoid such a mid-income trap will be a big challenge to China. Too rapid an expansion in service and shrinking in manufacturing will lead to such a trap, not solving the potential problem.

What should China do in order to maintain balanced, stable and sustainable economic development? As Chen(2014)has emphasized, China must continuously strengthen and improve its manufacturing industry and make it the strongest sector. It needs to diversify its manufacturing industry and particularly develop sectors that consume less natural resources and emit less pollution. Also, it should develop more manufacturing products that can be used to directly substitute current mass imports and the ones representing future trends.

Expanding and developing the service industry will be an irreversible trend. Eventually, the GDP in service will surpass 50% of its total GDP and jobs in service will be above 50% of the total employment. But the issues facing China will be how soon that will be, what types of services will be needed, and what types of jobs will be necessary to sustain this growth.

As discussed in the previous sections, growing of the service sector and especially shrinking of manufacturing should be gradual, not dramatic. Social services and insurance/financial service should be given the highest priority. China now has more than 200 million seniors. Providing more and better services to these seniors should be the government’s and the society’s responsibilities and that also creates large business opportunities. Insurance and financial service is quite underdeveloped in China and lags greatly when compared with other developed countries. Professional services, including legal, accounting, medical and psychological services, has huge potential for growth. Also, China needs to expand and improve its manufacturing services.

Another area is service export. As pointed out in the previous discussions, China’s service export is far behind many other countries. Currently only about 7% of its total export is in service. Raising this ratio to 12-15% of its total export in the future should be reasonable and achievable.

V. Conclusions

This paper provides a comprehensive study and international comparisons of the service industry throughout the world. The data of the economic structure changes over the years for different countries, particularly the changes of the percentages of service GDPs and service employments in these countries show that the path of service industry development is based on each country’s economic development level as well as its unique conditions. But generally speaking, the service industry becomes increasingly important when an economy advances.

In order to avoid the potential mid-income trap, a country needs to continuously improve its manufacturing industry and particularly its competitiveness and diversity. It needs to develop and expand the service sectors which are not only highly needed but also productive and skill-intensive. Otherwise, the low average productivity and low average wage will slow the aggregate demand and with it the whole economy.

China is facing huge challenges and its economy is at a turning point. In order to maintain stable and sustainable economic growth, China needs to adjust its economic structure and better develop the service industry. It especially needs to expand and develop its professional, social and manufacturing services to better support its development.

China needs to adjust its economic development strategy and rely more on domestic consumption. It needs to focus more on innovations and institutional reforms to sustain economic growth. Sustaining and improving international trade and particularly exports will still be essential to China’s economy and its future developments. Creating competitive advantages of its service industry and exporting more services will be crucial to China’s future success.

Acknowledgement and Data Sources

The author wants to thank University of the West for providing financial assistance to this research project(through the UWest Faculty Research Grant)and also wants to thank UWest students Adam Yuan and Kathleen Wu for their fine research assistance. This paper was presented at the 25th International Conference on the Pacific Rim Management, July 9-11th, 2015, Los Angeles. The author wants to thank the participants of the conference for their valuable comments.

Unless otherwise mentioned, all data sources used in this paper are from the World Bank at www.worldbank.org

References

Baumol, William J(1967), “ Macroeconomics of unbalanced growth:the anatomy of urban crisis.” Am Econ Rev 57:pp. 415-426.

Baumol, William. J.; Blackman, Sue. Ann. Batey.; Wolf, Edward. N.(1989). Productivity and American Leadership:The long view. Cambridge, Massachusetts, MIT Press.

Bell, Daniel.(1973). The Coming of postindustrial society:A venture in social forecasting. New York, Basic Books.(Consulted in the 1976 edition, with a new introduction by the author.)

Castells, Manuel and Aoyama, Yoku.(1993), “Paths towards the informational society:A comparative analysis of the transformation of employment structure in the G-7 countries, 1920-2005.” BRIE Working Paper No. 61. Berkeley Roundtable on the International Economy, University of California, Berkeley.

Chen, Yueyun(2014), “China’s Path to Sustainable, Stable and Rapid Economic Development:

From the Largest to the Strongest Manufacturing Country,” Academic Perspective, Volume 10, pp 84-106 .

Clark, Colin.(1957), The Conditions of Economic Progress, London:Macmillan.

Cohen, Stephen; Zysman, John.(1987). Manufacturing matters. The myth of the postindustrial economy. New York, Basic Books.

Conte A. and M. Vivarelli(2007), “Globalization and Employment:Imported Skill Biased Technological Change in Developing Countries,” Jena Economic Research Papers 2007-009, Jena.

Denison, Edward.(1985). Trends in American economic growth, 1929-1982. Washington. DC, Brookings Institution.

Dietrich Andreas(2009), “Does growth cause structural change, or is it the other way around? A dynamic panel data analysis for seven OECD countries.” Jena Economic Research Papers in Economics 2009-034.

Fisher, Allan GB(1939), “Production, primary, secondary and tertiary.” Econ Rec 15:pp. 22-38.

Hansen, Gary D. and Prescott, Edward C.(2002):‘Malthus to show’, American Economic Review, Vol. 92(4), pp. 1205-1217.

Krüger, Jens J(2008), “Productivity and structural change:a review of the literature.” J Econ Surv 22:pp. 330-363.

Kuznets, Simon(1966), Modern Economic Growth. Rate Structure and Spread, New Haven and London:Yale University Press.

Lewis, W. Arthur(1972), “ Reflections on Unlimited Labor,” in L. E. DiMarco(ed.)International Economics and Development(Essay in Honor of Raoul Prebisch), New York:Academic Press, pp. 75-96.

Lucas, Robert E(1988), “On the mechanics of economic development.” J Monetary Econ 22:pp. 3-42.

McKinsey & Company, Global Institute(2012)“Manufacturing the Future:The Next Era of Global Growth and Innovation.”

Monk, Peter(1989), Technological change in the information economy. London, Pinter.

Nelson, Richard(1981), “‘Research of productivity growth and productivity differences:Dead ends and new departures,” Journal of Economic Literature, 19/99:1029-1064.

Oulton, Nicholas(2001), “Must the Unbalanced Growth Rate Decline? Baumol’s Unbalanced Growth Rate Revisited,” Oxford Economic Papers, Vol. 53(4), pp. 605-627.

Pelka, GW(2005), Wachstum und Strukturwandel. Metropolis-Verlag, Marburg.

Porat, M.(1977). The information economy, Washington, DC, US Department of Commerce, Office of Telecommunications.

Potts, Jason and Tom Mandeville(2007), “ Toward an Evolutionary Theory of Innovation and Growth in the Service Economy,” Prometheus, vol. 25, issue 2, pages 147-159.

Romer, Paul M(1986), “ Increasing returns and long-run growth.” J Political Econ 94:pp. 1002-1037.

Romer, Paul M(1990), “Endogenous technological change.” J Political Econ 98, no. 5. Part 2:the problem of development:a conference of the institute for the study of free enterprise systems, pp S71–S103.

Rostow, Walt Whitman(1960), "The Five Stages of Growth-A Summary". The Stages of Economic Growth:A Non-Communist Manifesto. Cambridge:Cambridge University Press. pp. 4–16.

Sautter, Christian.(1976), “Lefficacite et la rentabilite de leconomie francaise de 1954 a 1974,” Economie et Statistique(Paris), p.68.

Silva, Eater G, Teixeira, Aurora AC(2008), “Surveying structural change:seminal contributions and a bibliometric account.” Structure Chang Econ Dyn 19:pp. 273-300.

Smith Adam(1776), An inquiry into the nature and causes of the wealth of nations. In:Campbell RH, Skinner AS, Todd WB(eds)Reprinted in 2 vols. Clarendon Press, Oxford.

Solow, Robert M(1956), “A contribution to the theory of economic growth.” Q J Econ 70:pp. 65-94.

Solow, Robert M(1957), “Technical change and the aggregate production function.” Rev Econ Stat 39:pp. 312-320.

Stiglitz, Joseph and Linda J. Bilmes(2012), “The Book of Jobs,” Vanity Fair.

Touraine, Alain.(1969). La societe post-industrielle. Paris, Denoel.

Turgot ARJ(1766), Reflections on the formation and the distribution of wealth. In:Meek RL(eds):Turgot on Progress, sociology and economics. Cambridge University Press, Cambridge, pp 119–134