Editor’s note:A version of this post first appeared on WalktheChat’s website. WalktheChat specializes in helping foreign organizations access the Chinese market through WeChat, the largest social network on the mainland.

A unicorn is a privately held startup company valued at over $1 billion. Although the term was coined in order to express the rarity of such companies, they are getting more common, especially in China.

Let’s study unicorns in one of their most common habitats.

Some of the highlights:

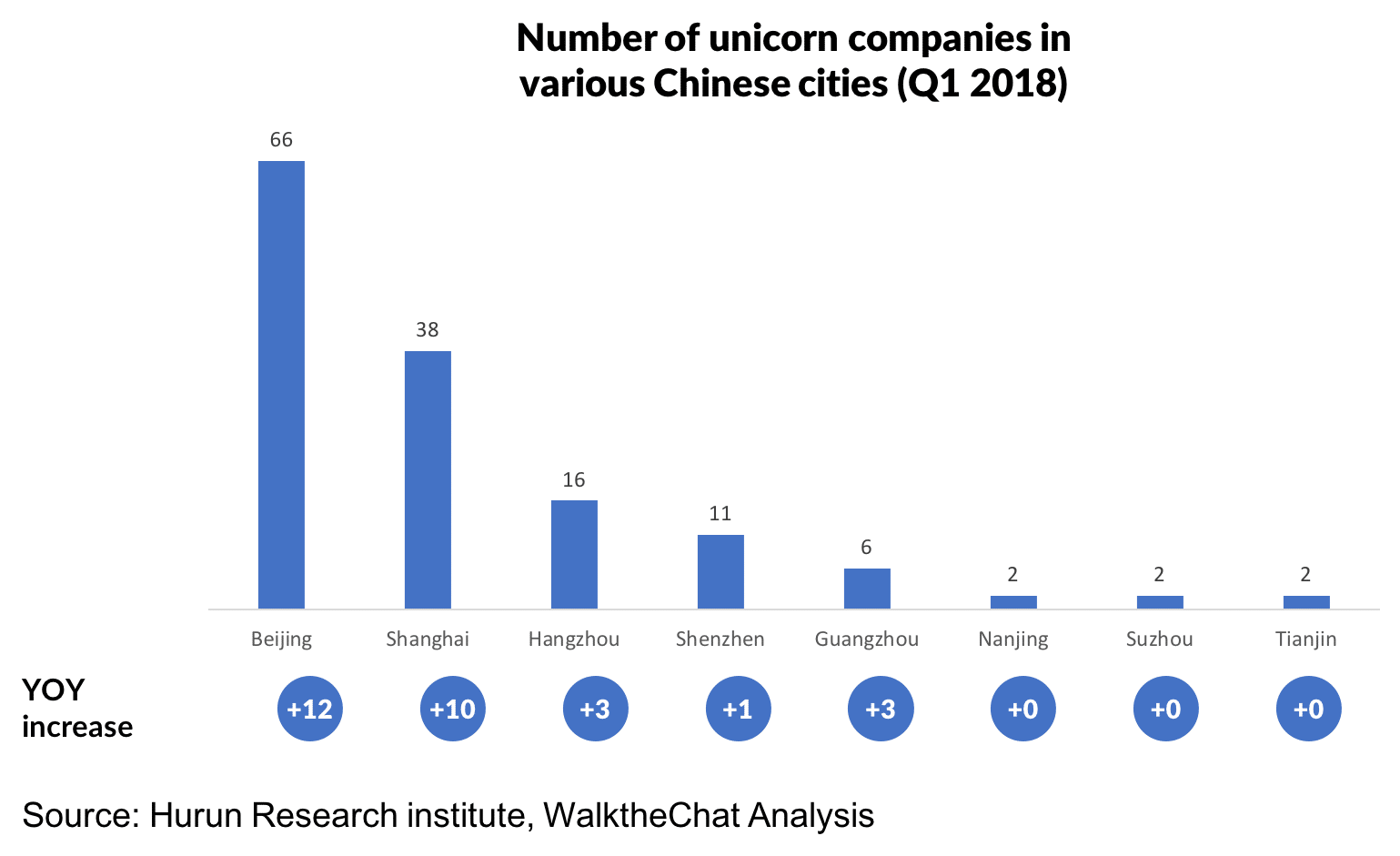

- The largest concentration of Chinese unicorns is located in Beijing (66 out of 151)

- Internet services are the largest and fastest growing industry for unicorn companies

- Almost 35% of Chinese unicorns are less than 4 years old

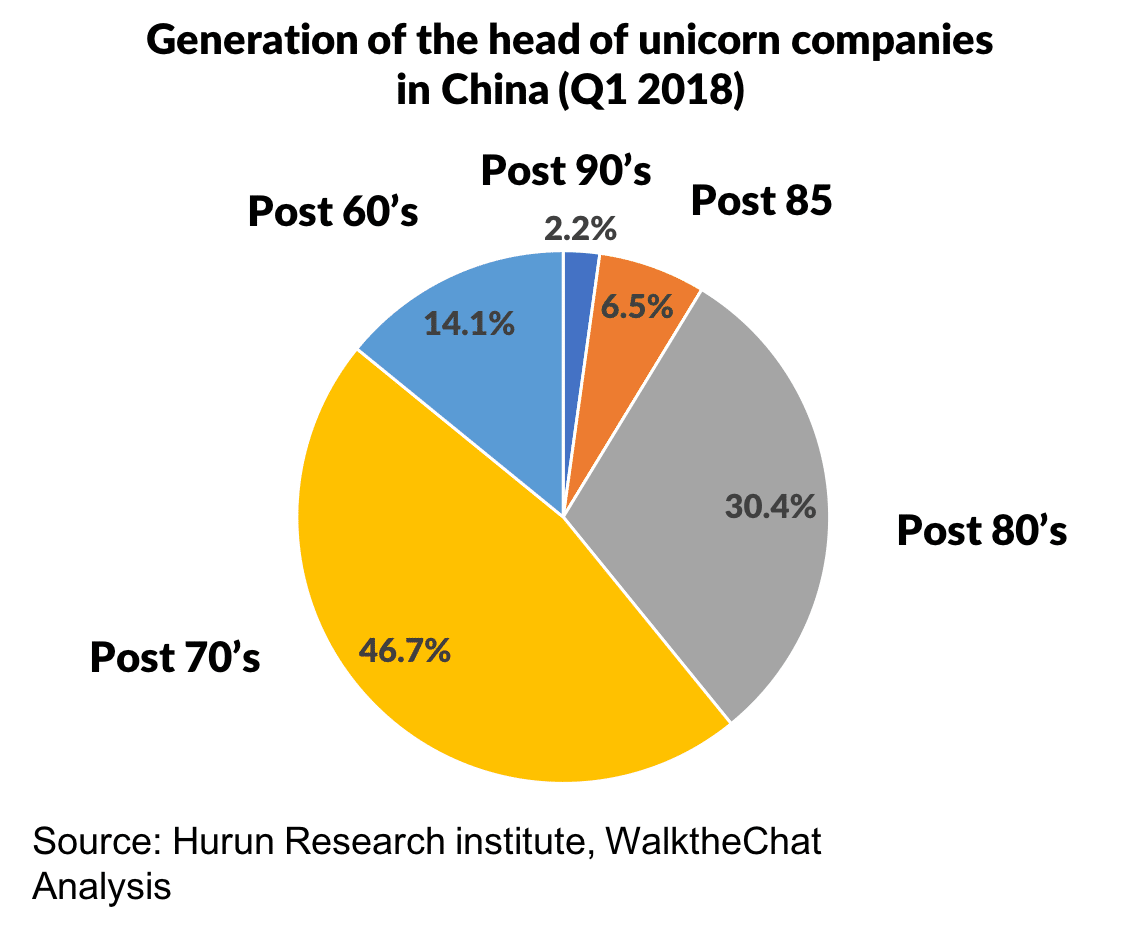

- Almost 40% of them are headed by post-80’s generation or younger leaders

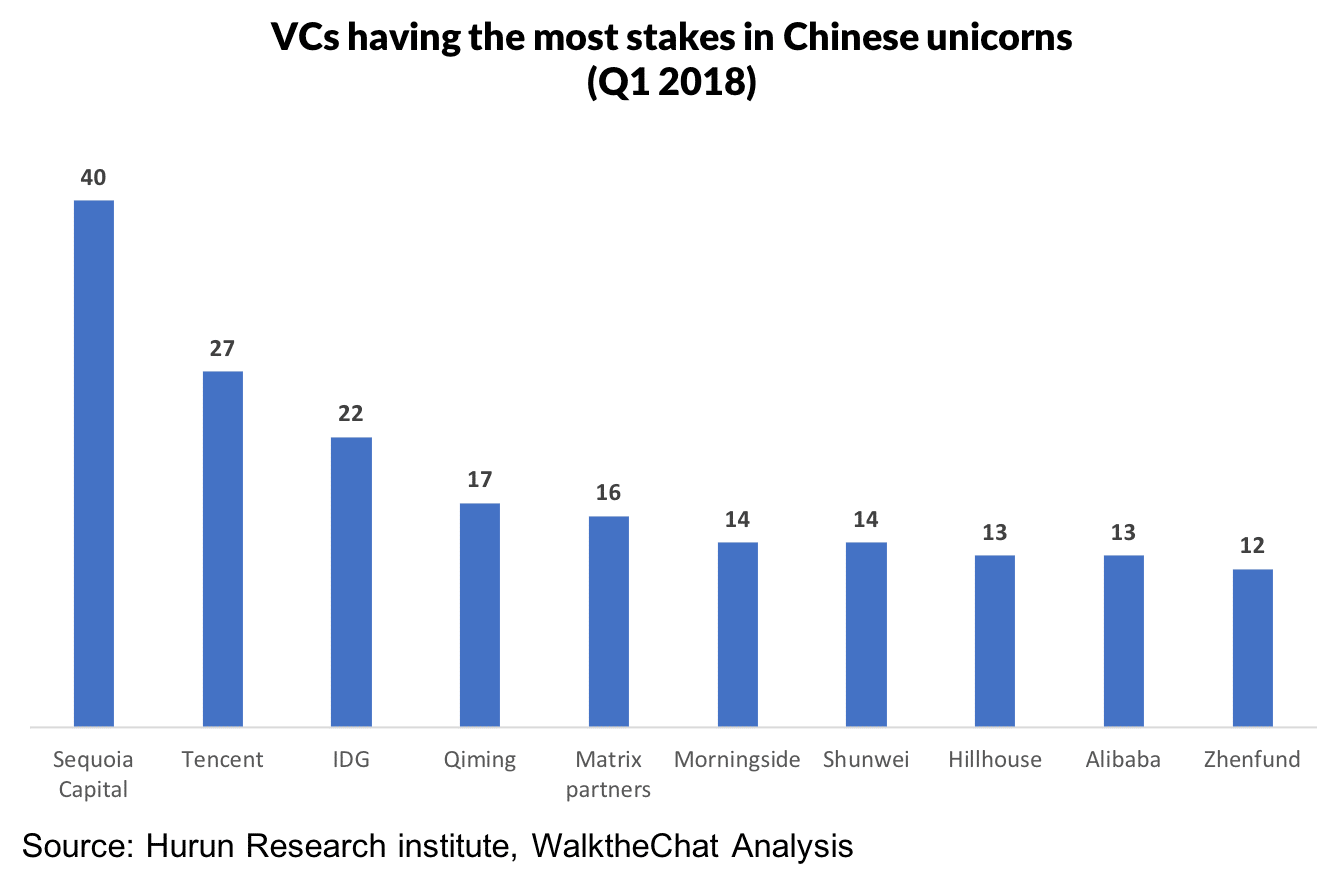

- Main investors in Chinese unicorn companies are Sequoia Capital, Tencent, and IDG

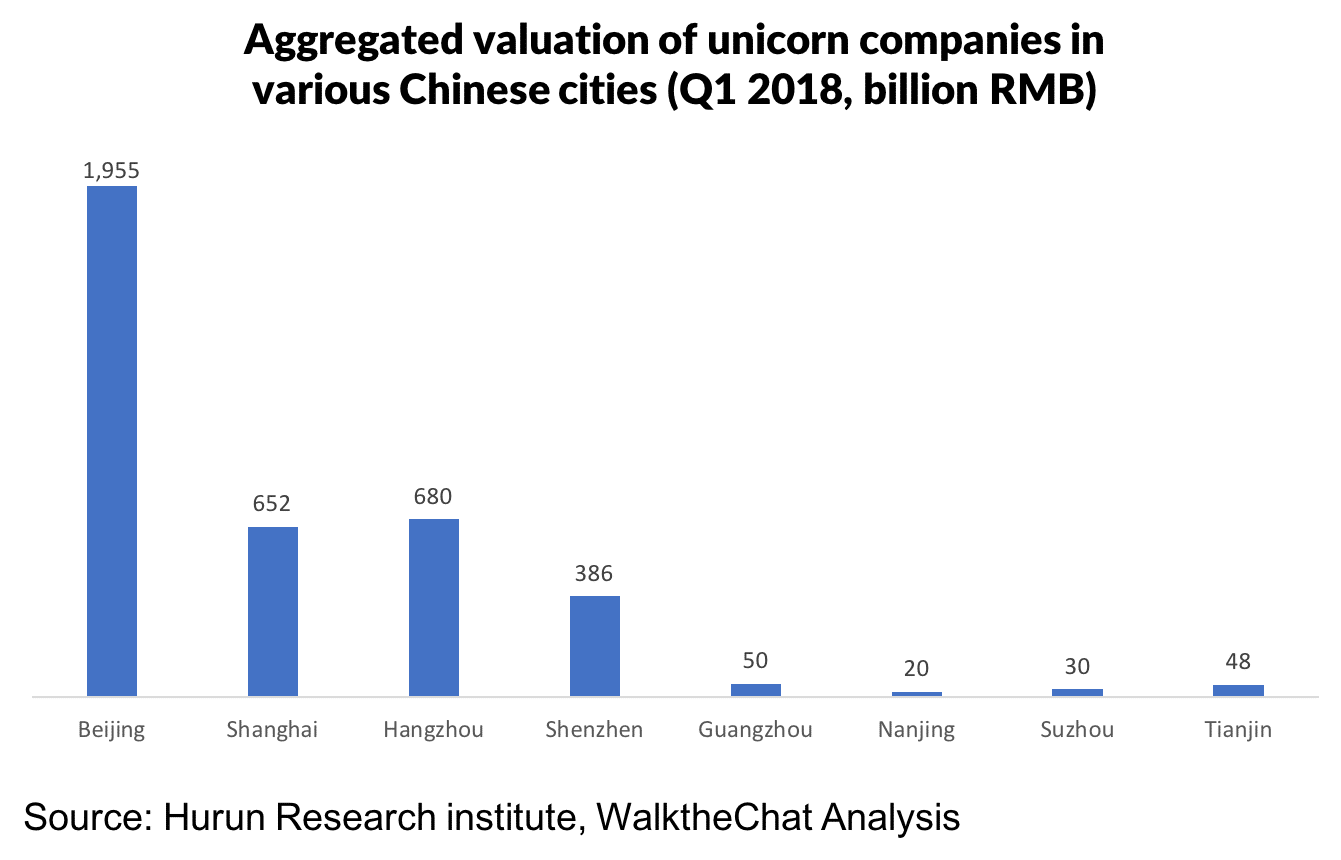

43% of Chinese unicorns are located in Beijing

Most Chinese unicorns are located in large Tier 1 cities. Beijing is the outstanding leader with 66 unicorn companies, followed by Shanghai(with “only” 38 of them).

Beijing & Hangzhou have the highest aggregated unicorn valuation

In terms of valuations, Beijing companies also tend to be more valuable than their peers. Beijing has less than twice as many unicorns as Shanghai, but more than 3 times the aggregated valuation of those in Shanghai.

Hangzhou, as a 2nd tier city, is showing great potential for startups. With 16 unicorns, the aggregated valuations reach RMB680 billion, ranking it second overall, and above Shanghai. It’s mostly due to Ant Financial, the super unicorn that is valued over RMB400 billion.

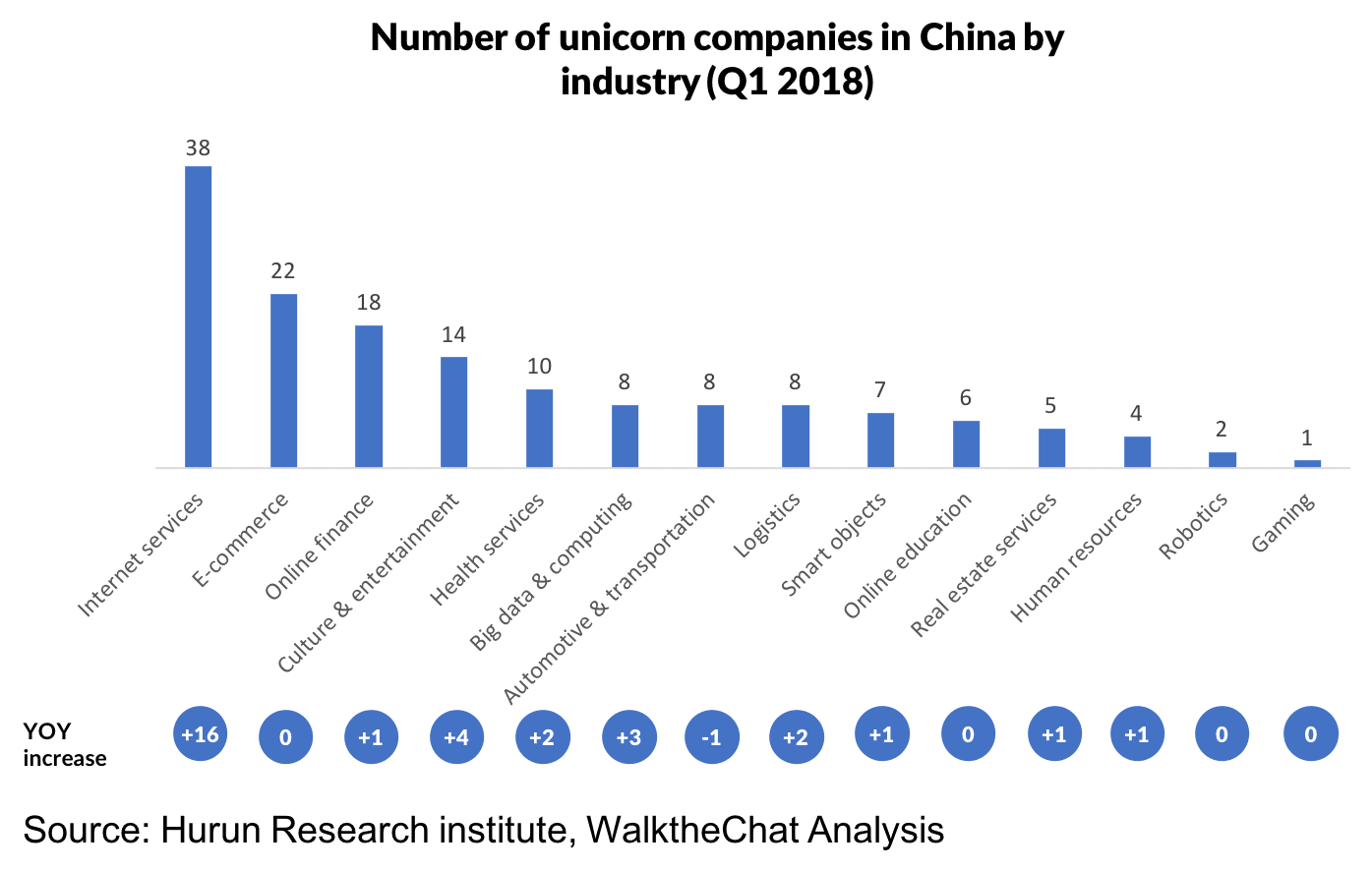

Internet Services is the largest category for unicorns

Unsurprisingly, internet services is the most common industry in which Chinese unicorn companies operate, followed by e-commerce and online finance. It’s also the one from which most new unicorns are coming.

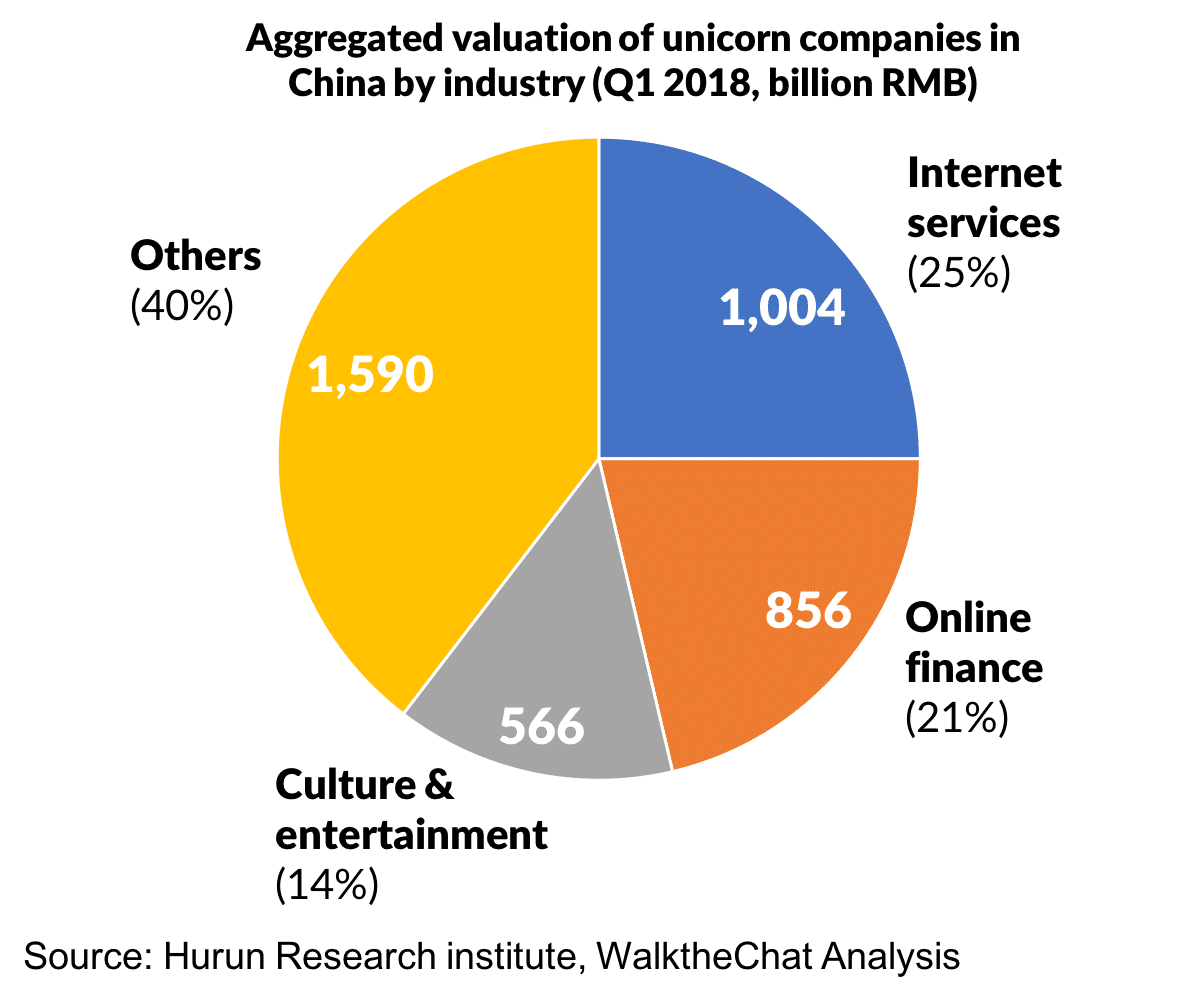

In terms of valuation, internet services, online finance, and culture & entertainment account for most of the valuation. Put together, these three industries make up 60% of all Chinese unicorn valuations.

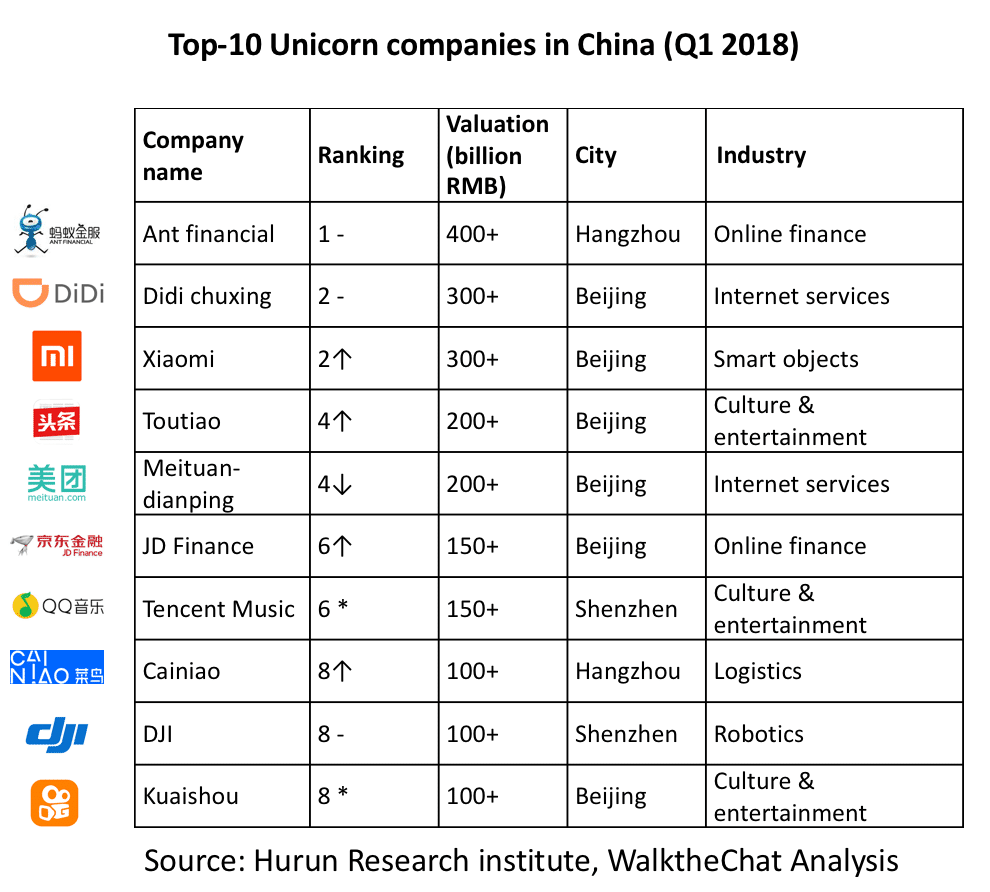

The top 10 super unicorns are valued over RMB100+ billion

The top-10 unicorns are some of the most famous companies in China, including Ant Financial(the financial arm of Alibaba that operates Alipay), ride-hailing company Didi Chuxing(which recently acquired the Chinese operations of Uber)and the startup Xiaomi.

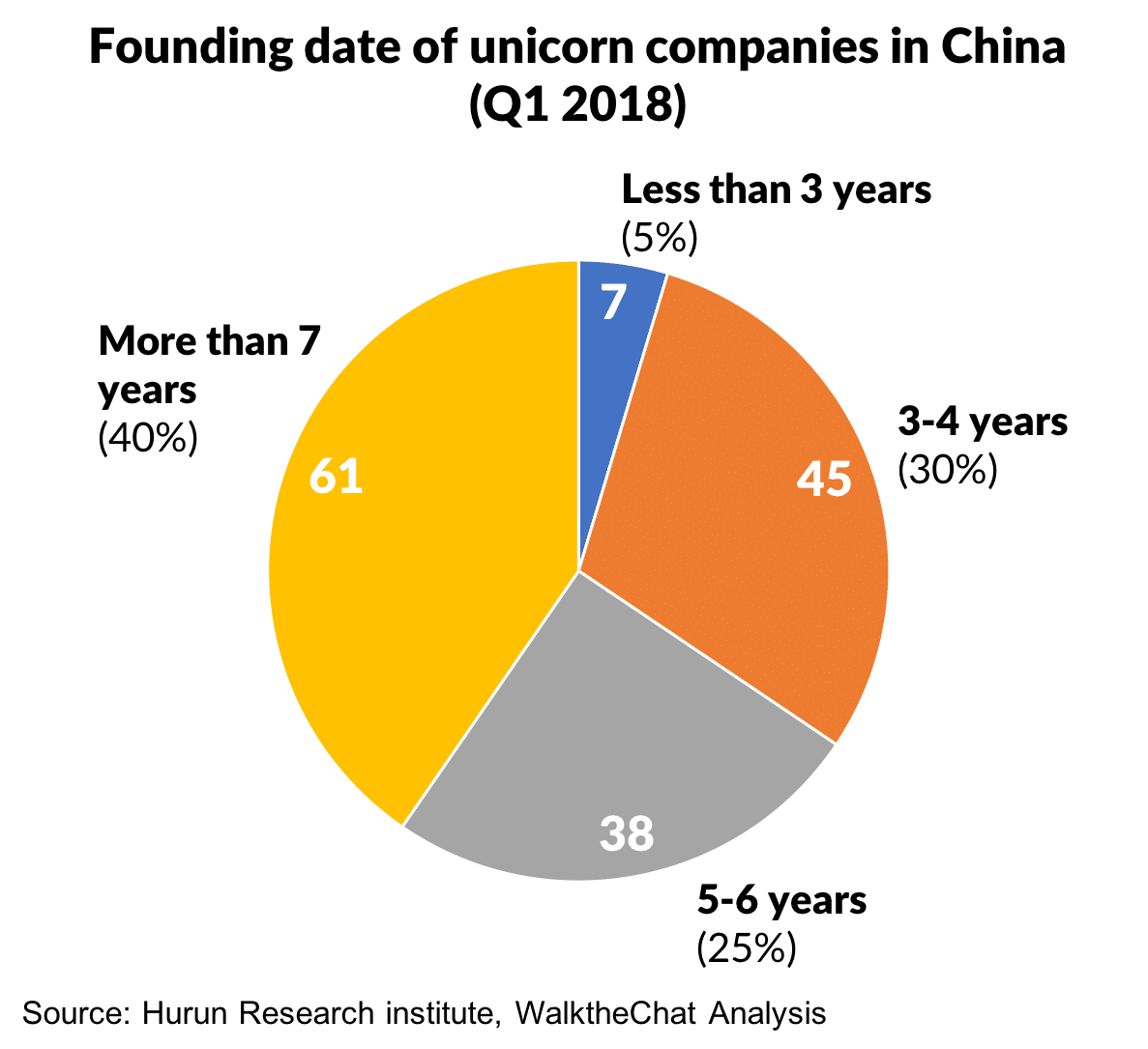

60% of Chinese unicorn companies were founded in the last 6 years

A significant amount of unicorns are young companies:35% of them are less than 4 years old, and 60% of them less than 6 years old.

The top VC funded 40 unicorns!

Some venture capitalists have been doing particularly well at identifying Chinese unicorn companies. Sequoia Capital leads the way, with investment in 40 Chinese unicorns, followed by Tencent with stakes in 22 companies and IDG who invested in 22 unicorn companies in China.

39.1% of China’s unicorn founders are younger than 38

Unicorn leadership is relatively young, with 39.1% of leaders born after 1980, an impressively young top-management for multi-billion dollar companies.