Leading economist and 2003 Nobel Laureate Robert Engle has agreed to serve as Co-Director of the Volatility Institute at NYU Shanghai(VINS). Engle, a professor of finance at NYU Stern and founder of Stern’s own Volatility Institute, has served on the advisory board of VINS since its founding. This summer, he will take up co-director duties alongside Professor of Economics Wang Jianye.

“Robert Engle invented the Volatility Institute and made it the world’s preeminent resource for analyzing systemic financial risk. When NYU Shanghai launched VINS, Robert helped ensure that it applies the same rigor in studying local data”, says Vice Chancellor Jeffrey Lehman. “His agreement now to serve as Co-Director shows just how far VINS has come in a very short period of time.”

Engle says he is excited about his new role and is looking to “increase the [Institute’s] research contribution and outreach to the Chinese finance community, and help VINS become more effective in engaging and reaching out to students.”

Established in 2014, VINS researchers work to provide thorough, scientific, and transparent analysis of market risk and volatility. The Institute aims to understand the dynamic China market, and how it influences and interacts with markets around the world.

The unpredictability of Chinese markets makes Shanghai a perfect laboratory for economists to experiment with predictive models. In 2015, Robert Engle and Zhou Xin, the executive director of VINS, used Engle’s ARCH model to predict the pricing of the first options offered on the Shanghai Stock Exchange. The results reflected a very narrow margin of error.

“With Robert Engle as the Co-Director of VINS, we will be able to contribute in a more meaningful way to the development of China financial markets,” said Zhou Xin. “We currently plan to work on a series of projects that analyze volatility and risk premiums in Chinese financial markets.”

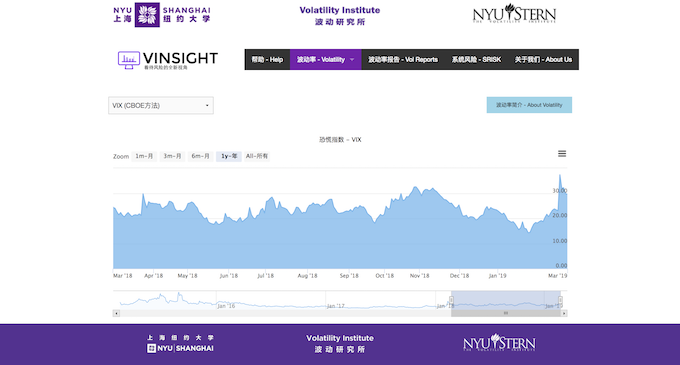

VINSIGHT tracks daily volatility and risk data across several assessment models.

NYU Stern and NYU Shanghai’s Volatility Institutes are close collaborators. For example, VINSIGHT, is a Stern/NYU Shanghai collaboration that provides daily volatility and systemic risk analysis of Chinese markets. Adapted to the Chinese market from NYU Stern’s V-Lab, it blends classic models such as Engle’s Nobel prize winning ARCH method with the latest advances in financial econometrics.

Last November, Engle was a keynote speaker at the fourth annual VINS conference at NYU Shanghai. At the conference, he proposed a three-step action plan that could help the Chinese market mitigate the geopolitical stress it is currently under. Step one:“reduce debt,” step two:“reassure investors,” and step three:“reopen trade negotiations”.

Two VINS events will be taking place this month:On March 19, Professor Wang Jianye will speak China and WTO Reform. Martin Wolf, associate editor and chief economics commentator at the Financial Times will speak on China in the World Economy:Co-operation or Conflict? on March 20.

著名经济学家、2003年诺贝尔奖得主Robert Engle教授将担任上海纽约大学波动研究所(VINS)联席所长。作为纽约大学斯特恩商学院金融学教授、斯特恩商学院波动研究所创始人,Robert Engle教授自上海纽约大学波动研究所成立以来,便一直担任其咨询委员会成员。今年夏天,他将与王建业教授共同担任联席所长。

“Robert Engle教授创立的纽约大学斯特恩商学院波动研究所,如今已是分析系统性金融风险的全球著名机构,”上海纽约大学常务副校长雷蒙表示。“当上海纽约大学创建波动研究所时,Engle教授提供帮助,确保其在研究本地数据时采取同样严谨的标准。Engle教授此次同意担任联席所长,表明上海纽约大学波动研究所在短时间内取得了很大的发展进步。”

Engle教授表示,很期待能够担任上海纽约大学波动研究所联席所长一职,希望能进一步“扩大波动研究所的研究贡献,与中国金融业建立起紧密联系,并能更有效地帮助有志于在该领域发展的学生。”

上海纽约大学波动研究所成立于2014年,研究人员致力于提供全面、科学、透明的关于市场风险和金融波动的分析。波动研究所的研究目标是洞悉中国市场动态,探究中国市场对全球市场的影响,以及中国市场和全球市场的互动关系。

中国市场的难以预测,使得上海成为经济学家实验与研究经济预测模型的绝佳场所。2015年,Engle教授与上海纽约大学波动研究所执行所长周欣博士,使用Engle教授的ARCH模型预测上海证券交易所的首批期权定价,实验结果几近精准。

“Engle教授担任上海纽约大学波动研究所联席所长,将帮助我们以更具有建设性的方式促进中国金融市场发展,”周欣博士说。“目前我们计划开展一系列项目,分析中国金融市场的波动与风险溢价。”

纽约大学斯特恩商学院波动研究所与上海纽约大学波动研究所紧密合作,VINSIGHT作为双方的合作成果,能够分析中国金融市场的日波动率与系统风险。该研究工具基于斯特恩商学院的波动实验室(V-Lab),面向中国市场进行了调整,融合了Engle教授获诺奖的ARCH模型等经典理论以及金融计量经济学领域的最新发展成果。

2018年11月,Engle教授在上海纽约大学波动研究所举行的第四届年会上发表主题演讲。就如何帮助中国市场减轻目前所面对的地缘政治压力,他提出“减少债务”、“打消投资者顾虑”、“重启贸易对话”的“三步走”行动计划。